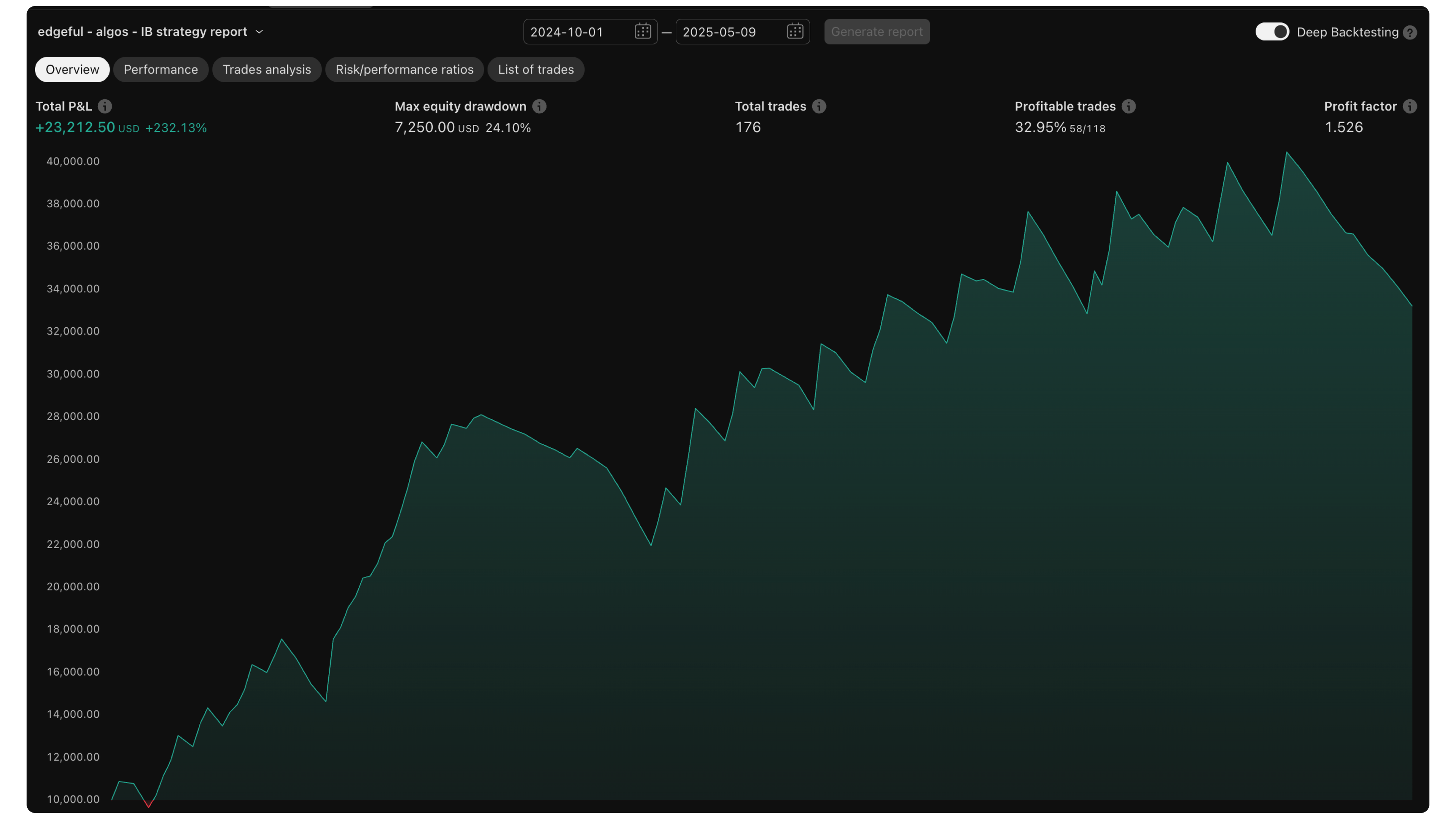

this information is not trading advice and should be used for educational purposes only. futures, options, and forex are leveraged instruments, and carry a high degree of risk. past results are not indicative of future returns. your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the information.

futures and forex trading contains substantial risk and is not for every investor. an investor could potentially lose all or more than the initial investment. risk capital is money that can be lost without jeopardising ones' financial security or life style. only risk capital should be used for trading and only those with sufficient risk capital should consider trading. past performance is not necessarily indicative of future results.

testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.