GC trading strategy: the initial balance algo that returned $106k in 12 months

before I get into this week’s stay sharp, I want to try a new format at the beginning of each email so you know how long it’s going to take to read, and the key takeaways.

READ TIME: 5-8 minutes

with that being said, let's get into this week's edition — which I want to start by asking you a question:

have you ever been in a trade and realized how emotional you were?

maybe your heart rate spikes every time you're close to a profit target, so you sell early and leave money on the table. or you stop yourself out before you should because you're scared to lose — and then price goes and hits your TP without you.

or maybe you've been stuck in a work meeting, unable to take the trade you planned after prepping for hours the night before.

if either of those hit home, this GC trading strategy is for you (and if emotions are the main issue, check out the trading mindset that separates consistent traders from everyone else.)

table of contents

- what is the initial balance

- why this GC trading strategy works

- the settings

- performance

- common mistakes

- key takeaways

what is the initial balance

the initial balance (IB) is the range formed by the high and low of the first hour of the trading session.

for GC during the NY session, that's 9:30am to 10:30am ET.

after that range is set, there are 3 scenarios:

- single break — price breaks one side and keeps going

- double break — price breaks both the high and low in the same session

- no break — price stays inside the range all day

why this GC trading strategy works

here's what the data shows on GC over the last 6 months:

- 79.23% single break

- 13.08% double break

- 7.69% no break

nearly 8 out of 10 times when GC breaks above or below one side of the IB range, it doesn't come back to test the other side.

so we can take this and build a GC trading strategy out of it. for more on how to read edgeful reports, see continuation vs reversal: how to know which reports to use.)

the settings

the algo uses:

- 1% retracement entry after the IB high or low breaks

- 60% retrace stop loss back into the IB range

- 0.25x and 0.5x IB range for profit targets

so if the IB range is 100 points, your first TP is 25 points above/below the IB high or low. your second TP is 50 points above or below.

here's a real example from January 2026:

the IB range was 32.8 points on GC. that means:

- TP1 = 8.2 points above the IB high (32.8 × 0.25)

- TP2 = 16.4 points above the IB high (32.8 × 0.50)

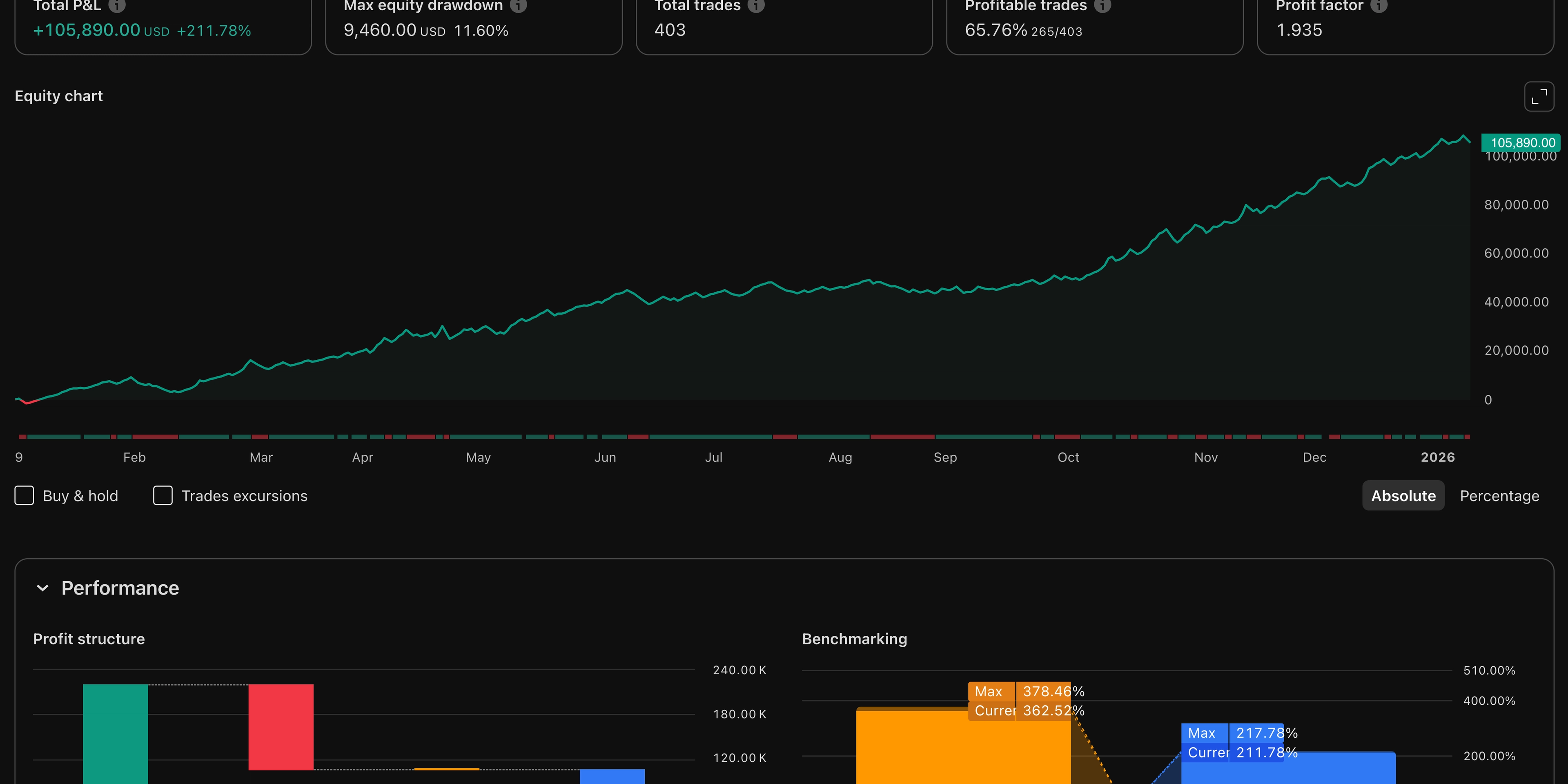

GC IB algo trading performance

here's what this GC trading strategy did over the last 12 months:

- +$105,890 return (on a $50k account, trading 2 contracts)

- 11.60% max drawdown

- 65.76% win rate

- 1.935 profit factor

I'm not saying if you run this starting tomorrow that you're going to make $100k in the next year. market conditions change, strategies go in and out of favor.

but I wanted to give you the opportunity to run it while it's still working.

it's working for our members

the best part about it is that our members are currently running the strategy and it's performing for them.

common mistakes

overriding the algo

the whole point of automating this GC trading strategy is to remove yourself from the equation. if you see the algo about to take a trade and decide "this one doesn't look right" — you're introducing the exact emotional decision-making it's designed to eliminate.

if you don't trust the settings, change them. but don't let your emotions get the best of you and override a trade just because "it doesn't look right".

overfitting

when backtesting and optimizing algos — traders try to remove every red day. that's not the goal.

example:

- Tuesday shorts lose $150 → leave it alone, that's practically breakeven

- Thursday longs lose $4,500 → remove it, that's an obvious loser

the goal is to remove obvious losers, not every small red day.

wrong timeframe

this GC trading strategy runs on a 5-minute chart. running it on 15-minute or 1-hour changes the signals completely.

not reoptimizing

the settings that work now won't work forever. I recommend reoptimizing at least once a month — download your trade data from the last 30, 60, and 90 days and look for patterns that have shifted.

key takeaways

- the initial balance on GC breaks in one direction 79% of the time over the last 6 months

- this GC trading strategy uses 1% retracement entry, 60% stop loss, and 0.25x/0.5x profit targets

- backtested: +$105,890 on $50k, 65.76% win rate, 1.935 profit factor

- automating removes emotions and means you never miss a setup

- don't override the algo, don't overfit, reoptimize monthly

if you want to learn more about the strategy, click below to get the free GC IB algo course →.

FAQs