spotting changing futures market environments with edgeful data

this week, I wanted to write about something that's been bothering me for months — how the futures market environment has dramatically shifted for some of our most popular setups, and how using edgeful has helped our traders spot these changes in real time. more importantly, I'm going to show you the exact process they follow — as well as some rules to implement — so you can avoid getting demolished by a changing market environment.

here's exactly what we're going to cover:

- the dramatic shift in gap fill report stats over the past few months in the current futures market environment — and why it matters

- the ORB report's huge shift from Q1 to Q4 of the exact same year as market environments changed (from an 80% edge to under 70% in some cases)

- what specific "red flags" to look for in the data to avoid trading setups that aren't working in the current market environment

- three concrete action steps to take when you see the futures market environment shifting against your strategy

by the end of today's stay sharp, you'll know exactly how to spot these market environment shifts BEFORE they wreck your account — and have the confidence to adapt your trading accordingly.

how the gap fill report shows dramatic shifts in futures market environments

let's start with one of the most popular setups that traders use in any futures market environment: the gap fill.

here's what the stats looked like on YM over the last 6 months:

the gap fill report shows:

- gaps up fill 66% of the time

- gaps down fill 65% of the time

these are solid stats that many traders (including myself) have relied on as a profitable strategy in previous market environments. but if you've been trading it, I'm sure you've had a tougher time more recently as the futures market environment shifted.

let's look at the stats for the same report and same ticker, just over the last month:

the stats have completely changed as the market environment evolved — especially for gaps up:

- gaps up fill just 50% of the time

- gaps down fill 67% of the time

this is a dramatic shift in the futures market environment! the gap up fill probability dropped by 16% from 66% to 50% — basically turning what was once a winner 7 out of 10 times to one that works 5 out of 10 times in the current market environment.

it doesn't sound crazy — but your PnL is likely very different trading a setup that works 67% of the time vs. something that works 50% of the time when the market environment changes.

to be completely transparent with you, this is exactly why I don't talk about the gap fill as much as I used to. I started noticing this shift in the futures market environment in December 2024… and if you've been blindly trading the gap fill, hoping for the stats to go back to the way they used to be, your account has probably been bleeding slowly (or quickly if you haven't realized the shift in market environment).

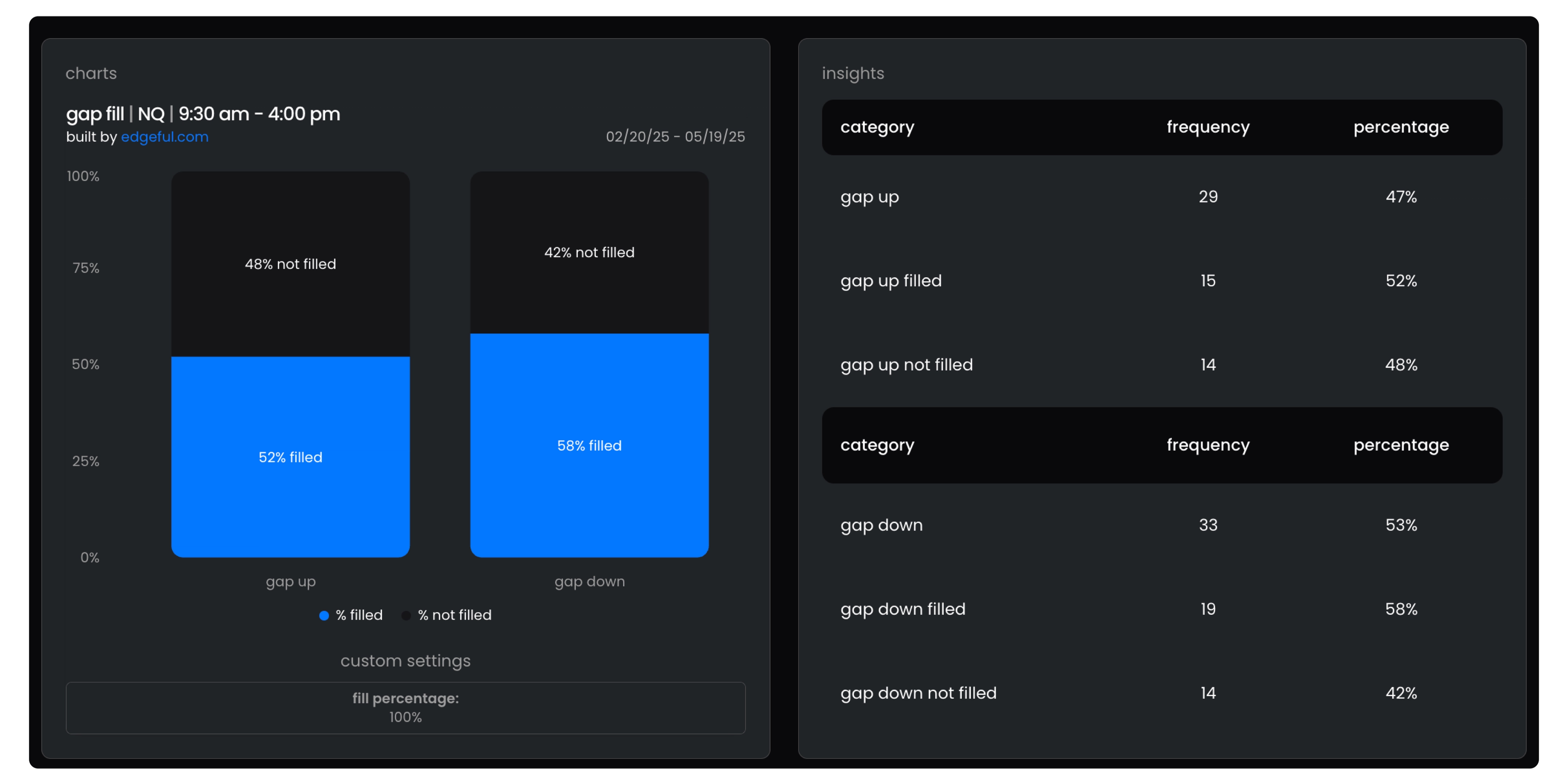

and it's not just YM — take a look at how NQ's market environment has changed:

over the last 3 months on NQ:

- gaps up fill 52% of the time

- gaps down fill 58% of the time

compare that to what the stats looked like just a few months earlier, from June to October 2024, before the futures market environment shifted:

during that period:

- gaps up filled 67% of the time

- gaps down filled 74% of the time

that's a 15% drop in gap up fills (from 67% to 52%) and a 16% drop in gap down fills (from 74% to 58%) as the market environment evolved!

this type of shift is exactly why our data is so powerful for tracking changing futures market environments — you're able to track dynamic shifts in the market environment in real time.

tracking significant changes in the ORB report across different market environments

it's not just the gap fill that stopped working as well as it once did — the ORB report has already undergone the exact same shift as the futures market environment changed.

here's what the stats say on ES in Q1 of 2024, in the previous market environment:

on ES during this 3 month period:

- breakouts happened 23.44% of the time

- breakdowns happened 15.6% of the time

- double breaks happened 61% of the time

the strategy in that market environment was clear — you could trade a break of one side of the ORB, targeting the other side of the ORB range, and it would work 6 out of 10 times. those are strong probabilities — and tons of edgeful traders made money using this ORB strategy during that market environment.

but let's take a look at Q4 of 2024, when the futures market environment had clearly shifted:

during this 3 month period (reminder — this is within the same calendar year!):

- breakouts happened 35.39% of the time

- breakdowns happened 29.23% of the time

- double breaks happened 35.38% of the time

night and day difference in market environments — and another perfect example of why you need to be checking the stats for your favorite reports and setups every single day as market environments evolve.

and for what it's worth, the stats in the current futures market environment still aren't great. here's data on ES over the last 3 months of this year:

- breakouts happened 25.81% of the time

- breakdowns happened 30.65% of the time

- double breaks happened 43.54% of the time

again — a slight improvement in the stats as the market environment shifted slightly, but not something you can confidently trade regularly in this market environment.

how to spot changing futures market environments in real-time

so how do you stay ahead of these market environment shifts before they destroy your account?

the key is looking for specific "red flags" in the data that signal a changing futures market environment:

- a 5% change against you should raise a yellow flag — be cautious about a potential shift in market environment, always checking the 1 and 3 month trends when compared to 6 month timeframes

- a 10%+ change against you is a red flag indicating a significant market environment shift — at this point, you've likely started seeing more losers than before, and it's time to change something in your trading to adapt to the new market environment

- one more red flag of a changing market environment is when you see a bunch of outliers in a row — for example, a small gap with 90% probability doesn't fill 3x in a row — clear feedback from the market that the environment is shifting and your trading needs to change as well

most traders miss these signals of changing market environments because they're not consistently checking the data. they find a setup they like, screenshot the stats once, and never look back until they've blown up their account when the market environment changes.

here's what I recommend for tracking changing futures market environments:

- regularly check your favorite reports using multiple timeframes (1-year, 6-month, 3-month)

- compare how the stats change across these timeframes to identify market environment shifts

- be especially alert when recent timeframes (last 3 months) show significantly different stats than the longer 6-month or 1-year timeframes, indicating a changing futures market environment

this is exactly what the edgeful dashboard is designed for — making it easy to spot these market environment changes before they cost you real money.

3 action steps when futures market environments shift against your strategy

when you notice these shifts in the futures market environment, here are the concrete steps you should take:

1) size down in changing market environments

SIZE DOWN — this is the most important action you can take once you see a yellow or red flag indicating a changing market environment. if you normally trade 2 contracts, cut back to 1. this immediately reduces your exposure and risk while you evaluate whether the setup is still worth trading in the new market environment.

2) check the "by weekday" subreport to adapt to market environment changes

CHECK THE "BY WEEKDAY" SUBREPORT — some days might still have strong probabilities even when the overall market environment has shifted. you can focus on trading only on the weekdays that still show 70%+ probabilities and completely avoid days that have dropped below 60% in the current market environment.

3) analyze other tickers in changing futures market environments

ANALYZE OTHER TICKERS — the setup that's failing on YM in the current market environment might still be working great on NQ, or the setup that's failing on ES might be working on YM. be flexible enough to switch tickers when the data tells you the market environment has changed.

I've learned the hard way that ignoring these market environment shifts can be incredibly costly. in December, I saw the gap fill stats declining as the market environment changed, took enough losses to realize I had to change something, and then sized down until I felt the strategy coming back into favor as the market environment stabilized.

and to be clear — it can take a couple of months for these market environment shifts to happen (if they do happen at all). the purpose of this stay sharp is to show you how to prepare yourself for changing futures market environments, and give you some clear guidelines so you don't blow up your account if the stats stop working as well as they used to.

how edgeful helps you navigate changing futures market environments

let's do a quick recap of what we covered today:

- the gap fill probabilities have declined dramatically in recent months as the futures market environment changed

- the stats from Q4 and Q1 of 2024 show completely different market environments on the ORB report — it doesn't even look like the same trade!

- look for 5% (yellow flag) and 10%+ (red flag) changes in probabilities that signal shifting market environments

- take concrete actions as the futures market environment changes: size down, focus on specific weekdays, consider switching tickers

literally the first thing I do each morning is check whether the stats on my favorite setups have changed due to shifting market environments. this daily habit has saved me from countless losing trades as the futures market environment shifts — and is something you can do yourself.

remember — the most successful traders aren't the ones who find one perfect strategy and trade it forever in all market environments. they're the ones who can adapt quickly when the futures market environment changes and when the stats back up the shift they're experiencing.