fair value gaps: FVG indicator for TradingView

most traders spend hours manually marking fair value gaps on their charts.

they draw boxes around every 3-candle imbalance, track which ones get filled, try to remember which timeframes show the best probabilities... and still end up missing trades or trading the wrong FVGs.

the FVG indicator eliminates all of that.

it automatically plots bullish and bearish fair value gaps on your TradingView charts, tracks whether they get mitigated or stay unmitigated during the session, and removes the clutter once price fills them.

on YM using 30-minute charts, 69% of bullish FVGs stay unmitigated and 68% of bearish FVGs stay unmitigated during the same trading session. that's not random—that's probability data you can build trades around.

in this article, you'll learn exactly what fair value gaps are, how the FVG indicator works, what the probabilities look like on YM, and how to use this tool in your actual trading without overcomplicating things.

table of contents

- what is the FVG indicator?

- what are bullish and bearish fair value gaps?

- how the FVG indicator works on TradingView

- YM FVG report stats (30min timeframe)

- how to use the FVG indicator in your trading

- customizing the FVG indicator

- does the FVG indicator work for stocks?

- frequently asked questions

- key takeaways

what is the FVG indicator?

the FVG indicator is a TradingView tool that automatically identifies and plots fair value gaps on your charts.

FVG stands for "fair value gap"—a 3-candle pattern that shows an imbalance in price where aggressive buying or selling leaves a gap between consecutive candles.

the FVG indicator tracks two key things:

- which FVGs form during the trading session

- whether those FVGs get "mitigated" (price comes back through) or stay "unmitigated" during the same session

here's the critical detail: the FVG indicator only tracks FVGs that form during the New York session (9:30am-4:00pm ET).

it also only checks if mitigation happens the same day. if an FVG forms today and gets filled tomorrow, that doesn't count in the data.

this session-specific, same-day measurement is what makes the FVG indicator reliable. you're not tracking random overnight gaps or multi-day patterns—you're measuring intraday behavior during active trading hours.

the FVG indicator works across all timeframes: 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, and beyond. different timeframes show different mitigation rates, so you'll want to check edgeful's FVG report for your specific timeframe.

what are bullish and bearish fair value gaps?

fair value gaps are 3-candle patterns that form when price moves aggressively in one direction, leaving an imbalance between candle 1 and candle 3.

bullish FVG

a bullish FVG forms when price moves up aggressively.

here's the pattern:

- candle 1 creates the low of the pattern

- candle 2 is the aggressive move up

- candle 3 creates the high of the pattern

if there's a gap between candle 1's high and candle 3's low, that's a bullish fair value gap.

this gap represents a demand imbalance—buyers were so aggressive that price skipped over certain levels without any real trading volume happening there.

bearish FVG

a bearish FVG forms when price moves down aggressively.

here's the pattern:

- candle 1 creates the high of the pattern

- candle 2 is the aggressive move down

- candle 3 creates the low of the pattern

if there's a gap between candle 1's low and candle 3's high, that's a bearish fair value gap.

this gap represents a supply imbalance—sellers were so aggressive that price dropped through levels without any real volume or liquidity.

mitigation vs unmitigated

when we say an FVG gets "mitigated," we mean price comes back through the gap zone.

- bullish FVG mitigated: price drops back down into the gap and closes through it

- bearish FVG mitigated: price rallies back up into the gap and closes through it

when an FVG stays "unmitigated," price never returns to that zone during the same trading session.

this is what the FVG indicator tracks—how often do these gaps actually get filled versus how often they stay open?

how the FVG indicator works on TradingView

the FVG indicator plots fair value gaps automatically as they form in real-time during the trading session.

here's how it works:

step 1: FVGs are identified and plotted

when a 3-candle pattern creates a gap, the FVG indicator draws a box around that zone on your chart. bullish FVGs show up as green boxes (default), bearish FVGs show up as red boxes.

step 2: only unmitigated FVGs stay visible

once price comes back through an FVG and closes through it (mitigation), the FVG indicator removes that box from your chart.

this keeps your chart clean. you only see FVGs that are still "active" and haven't been filled yet.

step 3: session-specific tracking

the FVG indicator only tracks fair value gaps that form during the New York session (9:30am-4:00pm ET).

if an FVG forms overnight, pre-market, or after hours, it doesn't show up in the indicator and it's not part of the probability data.

step 4: same-day mitigation only

if an FVG forms at 10:00am and price comes back to fill it at 2:00pm, the indicator removes it because it got mitigated the same day.

if that FVG stays open through 4:00pm and gets filled the next morning, it's counted as "unmitigated" for that session.

this same-day measurement is critical for understanding intraday probabilities.

customizable timeframes

you can use the FVG indicator on any timeframe you want:

- 1-minute charts for scalping

- 5-minute charts for active day trading

- 15-minute charts for swing entries

- 30-minute charts for cleaner, more significant FVGs

- 1-hour+ charts for the strongest reversal zones

different timeframes will show different mitigation rates. a 5-minute FVG might have a 75% mitigation rate, while a 30-minute FVG might only have a 30% mitigation rate.

always check edgeful's FVG report for your specific timeframe to know the actual probabilities.

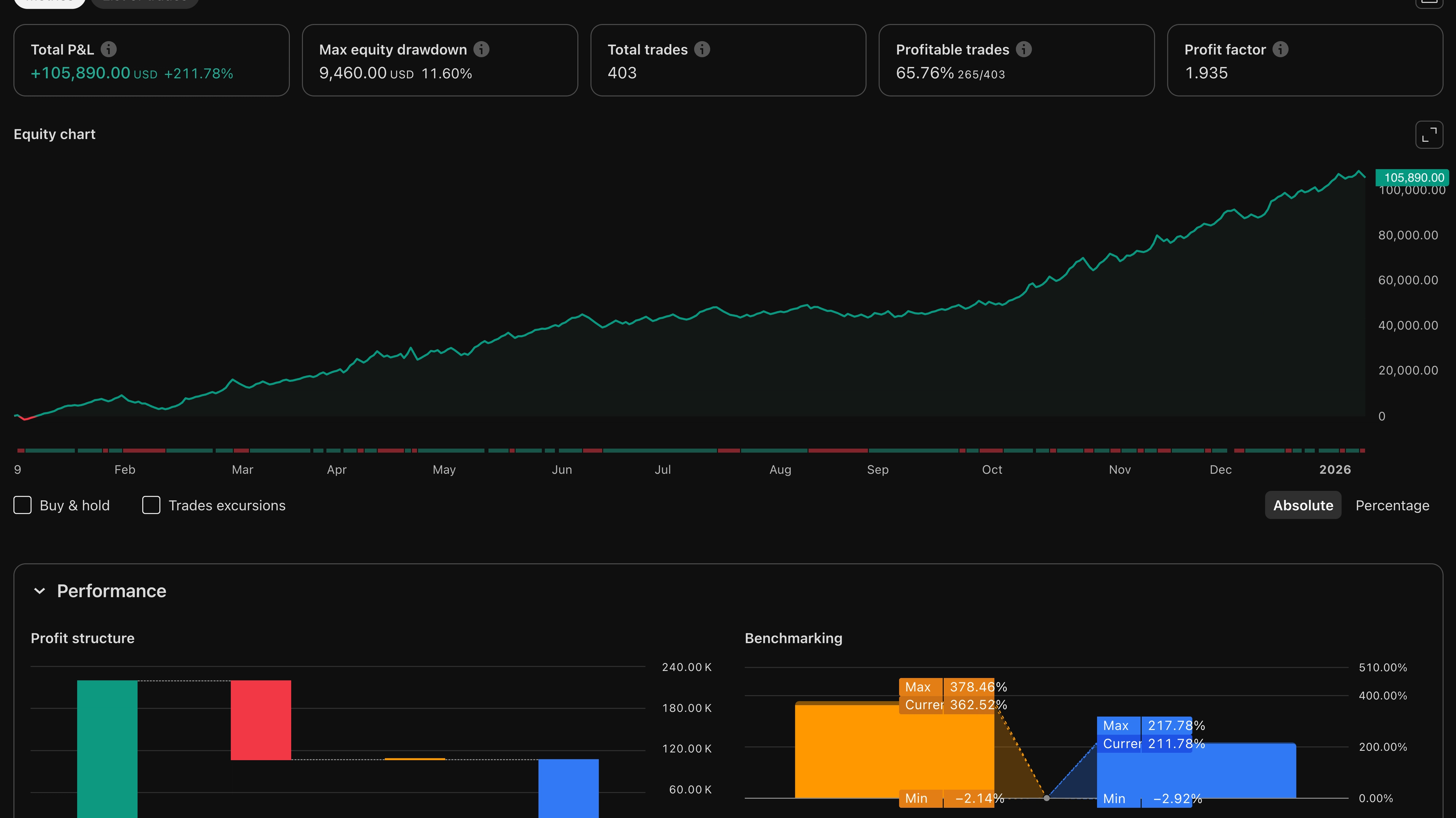

YM FVG report stats (30min timeframe)

here's the actual data for YM (Dow Jones futures) using 30-minute fair value gaps over the last 6 months in the New York session:

bullish FVG stats:

- 69.46% stay unmitigated during the same session (116 occurrences)

- 30.54% get mitigated during the same session (51 occurrences)

- total: 167 bullish FVGs tracked

bearish FVG stats:

- 67.52% stay unmitigated during the same session (79 occurrences)

- 32.48% get mitigated during the same session (38 occurrences)

- total: 117 bearish FVGs tracked

what this data tells you

about 7 out of 10 fair value gaps on the 30-minute timeframe do NOT get filled the same day they form.

this is important for how you think about FVGs:

if you're targeting an FVG as a profit zone, understand that there's roughly a 30% chance price will actually reach it during the session.

if you're using an FVG as a reversal area, understand that there's roughly a 70% chance price won't come back to test it during the session.

the 30% of FVGs that do get mitigated can be high-probability target zones when combined with other confluence like session bias, opening range breaks, or previous day's range levels.

these stats are YM-specific

ES will show different mitigation rates. NQ will show different rates. gold, crude oil, Bitcoin—all different.

and different timeframes on the same ticker will also show different rates. YM's 5-minute FVGs might have a 75% mitigation rate, while the 30-minute FVGs (as shown above) have a 30% mitigation rate.

always check edgeful's FVG report for your specific ticker and timeframe before building trades around these probabilities.

how to use the FVG indicator in your trading

step 1: add the FVG indicator to TradingView

log into edgeful and connect your TradingView account. once you do that, the FVG indicator will appear in your "invite only" indicators section on TradingView.

add it to your chart along with your other indicators.

step 2: choose your timeframe

decide which timeframe you want to trade FVGs on. this depends on your trading style:

- 1-5 minute charts: best for scalpers who want fast entries and exits

- 15-30 minute charts: best for day traders looking for cleaner, more significant zones

- 1-hour+ charts: best for swing traders targeting the strongest FVG levels

remember: different timeframes have different mitigation rates. check the FVG report on edgeful for your chosen timeframe's probabilities.

step 3: watch for FVGs to form during the session

as the NY session progresses (9:30am-4:00pm ET), the FVG indicator will automatically plot new fair value gaps as they form.

you'll see green boxes for bullish FVGs and red boxes for bearish FVGs.

using FVGs as reversal zones

when a bullish FVG forms and price pulls back to it, that zone can act as a demand area where buyers might step in.

when a bearish FVG forms and price rallies back to it, that zone can act as a supply area where sellers might step in.

example: if YM forms a bullish FVG at 43,500 and price drops back down to that zone later in the session, you're looking for long entries with a stop below the FVG.

based on the 30-minute data, there's about a 30% chance price actually comes back to test that FVG. but when it does, it can be a high-probability reversal zone.

using FVGs as profit targets

if you're already in a trade and an FVG forms in the direction of your target, it can serve as a potential exit zone.

example: you're long on YM at 43,400. a bearish FVG forms at 43,600. you can use that FVG zone as a profit target, understanding that there's about a 30% chance price reaches it during the session.

combining FVGs with other setups

the FVG indicator works best when you stack it with other high-probability data:

- FVG + opening range breakout: if ORB breaks to the upside and a bullish FVG forms, you have confluence for continuation

- FVG + previous day's range: if previous day's high breaks and bullish FVGs start forming, session bias is bullish

- FVG + gap fill: if an FVG aligns with a gap fill level, you get double confluence for the target

the more data points aligning, the stronger your edge.

timeframe selection matters

5-minute charts will show you more FVGs forming throughout the session. some will be significant, others will be noise.

30-minute charts will show you fewer FVGs, but they'll be more significant zones that carry more weight.

1-hour+ charts will give you the cleanest, strongest FVG levels—but you'll see far fewer of them.

match your timeframe to your trading style and always verify the mitigation rates for that specific timeframe on edgeful.

customizing the FVG indicator

the FVG indicator is fully customizable on TradingView.

change FVG colors

the default colors are green for bullish FVGs and red for bearish FVGs. if those don't work with your chart theme, you can change them to any color.

adjust box transparency

if the FVG boxes are too bold and cover too much of your chart, you can increase transparency to make them more subtle.

toggle labels on or off

the FVG indicator can show labels like "bullish FVG" or "bearish FVG" on each box. if you find labels cluttered, turn them off in the settings.

select which session to track

by default, the FVG indicator tracks the New York session (9:30am-4:00pm ET). but you can switch it to track London, Tokyo, or Sydney sessions if you trade those hours.

remember: edgeful's FVG report data is based on the NY session, so if you switch to a different session, your probabilities will be different.

choose your timeframe

you can set the FVG indicator to scan for gaps on any timeframe: 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, or higher.

the indicator will only show FVGs for the timeframe you select, keeping your chart clean and focused.

important note: indicator only shows unmitigated FVGs

once price closes through an FVG and mitigates it, the FVG indicator removes that box from your chart automatically.

this keeps your chart clean and ensures you're only looking at active, unmitigated FVGs that are still relevant for the current session.

does the FVG indicator work for stocks?

yes, but with some limitations.

the FVG indicator works on any asset class: futures, forex, crypto, and stocks.

however, stocks only trade during regular hours (9:30am-4:00pm ET). there's no overnight session, which means you'll see fewer FVG opportunities compared to 24-hour markets like futures.

best instruments for the FVG indicator

the FVG indicator works best on markets with continuous trading:

- futures: ES, NQ, YM, RTY, CL, GC

- forex: EUR/USD, GBP/USD, USD/JPY

- crypto: Bitcoin, Ethereum

these markets have 24-hour sessions, which means FVGs can form overnight and during multiple global sessions. more trading hours = more FVG opportunities.

for stocks, the FVG indicator will still plot gaps that form during regular trading hours. you'll just see fewer of them compared to futures.

always check edgeful's FVG report for your specific ticker—whether it's a stock, future, or crypto—to see the actual mitigation rates.

frequently asked questions

what is the FVG indicator?

the FVG indicator automatically plots fair value gaps on TradingView and tracks whether they get mitigated or stay unmitigated within the same trading session. on YM 30-minute charts, about 70% of FVGs stay unmitigated during the session.

how do I add the FVG indicator to TradingView?

log into edgeful, connect your TradingView account, and the FVG indicator will appear in your "invite only" indicators section. add it to your chart and customize the timeframe and session settings.

what's the difference between bullish and bearish FVGs?

bullish FVGs form when price moves up aggressively, leaving a gap between candle 1's high and candle 3's low. bearish FVGs form when price moves down aggressively, leaving a gap between candle 1's low and candle 3's high. both are 3-candle imbalance patterns.

does the FVG indicator work on all timeframes?

yes. you can use the FVG indicator on 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, or any timeframe. different timeframes show different mitigation rates, so always check edgeful's FVG report for your specific timeframe's probabilities.

can I use the FVG indicator for stocks?

yes, but stocks only trade 9:30am-4:00pm ET, so you'll see fewer FVG opportunities compared to 24-hour markets like futures, forex, and crypto. the indicator works the same way—it just has fewer hours to track FVG formation and mitigation.

key takeaways

- the FVG indicator automatically plots fair value gaps on TradingView

- tracks mitigation rates within the same trading session (9:30am-4:00pm ET for NY session)

- on YM 30-minute charts, 69% of bullish FVGs and 68% of bearish FVGs stay unmitigated

- bullish FVGs form when price moves up aggressively (3-candle pattern with gap)

- bearish FVGs form when price moves down aggressively (3-candle pattern with gap)

- only shows unmitigated FVGs on the chart—mitigated ones disappear automatically

- session-specific tracking: only counts FVGs formed during the selected session

- customizable timeframes: 1min, 5min, 15min, 30min, 1hr, etc.

- works on futures, forex, crypto, and stocks

- different tickers and timeframes have different mitigation rates

- check edgeful's FVG report for your specific ticker and timeframe data

- combine FVGs with other setups like ORB, previous day's range, and gap fills for maximum confidence

p.s. want access to the FVG indicator and all our other custom TradingView indicators? get started with edgeful here