RSI indicator explained: how to actually use it for trading

the relative strength index is one of the most popular indicators in trading... and one of the most misunderstood. if you've been using it wrong — or not using it at all because you've seen others fail with it — this breakdown will show you what the RSI indicator actually measures, when it works, and when it'll get you killed.

table of contents

- what is the RSI indicator

- how RSI is calculated

- the overbought and oversold trap

- how to actually use RSI in futures trading

- rsi divergence: the signal most traders miss

- combining RSI with other tools

- common RSI mistakes to avoid

- key takeaways

what is the rsi indicator

the relative strength index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes. developed by J. Welles Wilder in 1978, it's designed to identify whether an asset is potentially overbought or oversold.

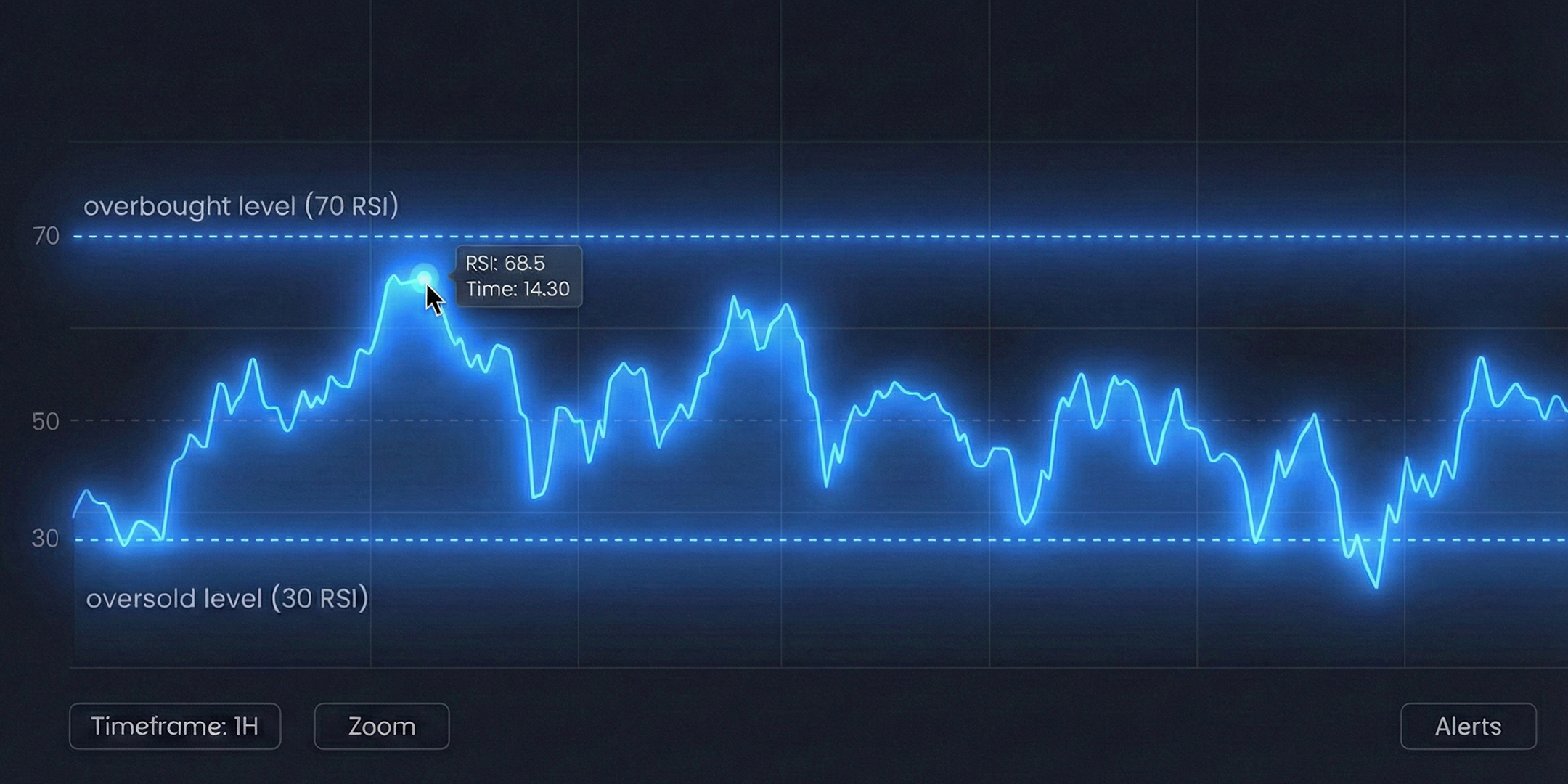

the RSI oscillates between 0 and 100. traditionally, readings above 70 suggest overbought conditions, while readings below 30 suggest oversold conditions.

but here's what most traders don't realize — those levels aren't buy and sell signals. they're just momentum clues.

the RSI tells you about momentum, not direction. an ETF, stock, or futures instrument can stay "overbought" for weeks during a strong uptrend. similarly, something can remain "oversold" while it continues drilling to new lows. I've seen plenty of traders blow up accounts trying to fade strong trends just because the RSI hit an extreme level.

how RSI is calculated

you don't need to calculate RSI by hand — every charting platform does it for you. but understanding the math helps you understand what you're actually looking at.

the formula uses average gains and losses over a specified period (usually 14 periods):

- RSI = 100 - (100 / (1 + RS))

- where RS (relative strength) = average gain / average loss

what this means in plain english: the RSI compares how much price has gone up versus how much it's gone down over the lookback period. when gains dominate, RSI rises. when losses dominate, RSI falls.

the default 14-period setting works for most applications. shorter periods (like 7 or 9) make the indicator more sensitive and generate more signals — but also more false signals. longer periods (like 21 or 25) smooth things out but react slower to price changes.

for day trading futures, I typically see traders stick with the 14-period on their primary timeframe, then check a higher timeframe for confirmation.

overbought vs oversold — what do these terms really mean when it comes to RSI trading?

this is where most traders go wrong with RSI.

they see RSI hit 70 and immediately think "time to short." or RSI drops to 30 and they start buying aggressively. this works sometimes — usually in choppy, range-bound markets. but it fails spectacularly when markets trend.

here's the reality: during strong trends, RSI can stay overbought or oversold for extended periods. but depending on the ticker, you may find edge in trading the ranges.

here’s an example on NQ from 2025 to now:

you can see that NQ rarely stays above the 70 oversold level for much time, but can spend multiple weeks near that level while trending.

but then compare that ES, and you’ll see a slightly different picture:

even less time above the RSI 70 level.

here’s the lesson:

overbought doesn't mean "sell" and oversold doesn't mean "buy." it means momentum is strong in that direction. sometimes the right move is to trade with that momentum, not against it.

how to actually use RSI in futures trading

so if you shouldn't blindly buy oversold and sell overbought, how should you use RSI? here are three approaches that actually work.

1. RSI as trend confirmation

instead of using RSI to call reversals, use it to confirm trend direction.

when RSI consistently holds above 50, the market has bullish momentum. when it consistently stays below 50, momentum is bearish. the 50 level acts as a centerline — a dividing line between bulls and bears.

this is particularly useful for futures trading on ES and NQ. before taking a long setup, check if RSI is above 50 on your primary timeframe. it's a simple filter that can keep you out of counter-trend trades that have lower probability.

2. RSI divergence signals

divergence is when price makes a new high or low, but RSI doesn't confirm it. this disconnect often signals weakening momentum and potential reversals.

- bullish divergence: price makes a lower low, but RSI makes a higher low. this suggests selling pressure is weakening even though price is still falling.

- bearish divergence: price makes a higher high, but RSI makes a lower high. this suggests buying pressure is weakening even though price is still rising.

3. RSI failure swings

a failure swing is a specific RSI pattern that doesn't depend on price at all — it's purely based on RSI movement.

bullish failure swing:

- RSI falls below 30 (oversold)

- RSI bounces back above 30

- RSI pulls back but stays above 30

- RSI breaks above its prior high

bearish failure swing:

- RSI rises above 70 (overbought)

- RSI falls back below 70

- RSI bounces but stays below 70

- RSI breaks below its prior low

wilder considered failure swings to be strong reversal signals. they're relatively rare, but when they occur, they often precede significant moves.

combining RSI with other tools

RSI works best when combined with other analysis — not used in isolation.

RSI + support/resistance

RSI signals carry more weight at key support and resistance levels. an oversold RSI reading at a major support level is more meaningful than an oversold reading in the middle of nowhere.

RSI + moving averages

combining RSI with moving averages gives you both momentum and trend context. for example, only take RSI buy signals when price is above the 20 EMA. this keeps you trading with the trend rather than against it.

RSI + volume

volume confirms the validity of RSI signals. an RSI divergence with declining volume is more significant than one occurring during normal volume conditions.

RSI + price action

ultimately, price action should be your final filter. RSI might show oversold conditions, but if price is forming lower highs and lower lows with no sign of buyers stepping in, the indicator alone isn't enough reason to go long.

at edgeful, we focus on data-driven approaches rather than relying on any single indicator. probability-based analysis using historical data often provides more reliable signals than traditional indicator readings.

common RSI mistakes to avoid

mistake 1: using RSI in isolation

RSI should confirm your thesis, not create it. if you're buying solely because RSI is oversold, you're gambling. combine it with price structure, volume, and broader market context.

mistake 2: ignoring the trend

fading trends because RSI is "too high" or "too low" is a fast way to blow up an account. always consider the larger trend before taking counter-trend signals.

mistake 3: using wrong settings for your timeframe

a 14-period RSI means different things on different timeframes. on a 5-minute chart, you're looking at the last 70 minutes of data. on a daily chart, you're looking at roughly three weeks. adjust your expectations accordingly.

mistake 4: expecting precise entries

RSI can stay extreme longer than you can stay solvent. even valid divergence signals can take time to play out. don't expect indicator signals to give you perfect entries — they provide context, not precision.

mistake 5: not backtesting your approach

before using any RSI-based strategy live, backtest it on historical data. you might find that certain RSI strategies work better on specific instruments or during specific market conditions.

RSI settings: what actually matters

the default 14-period setting works for most situations, but here's when you might adjust:

shorter periods (7-9):

- more signals (and more false signals)

- better for scalping and short-term trading

- more reactive to recent price changes

longer periods (21-25):

- fewer signals but potentially more reliable

- better for swing trading

- smoother, less noise

adjusting overbought/oversold levels:

- 80/20 instead of 70/30 for fewer but more extreme signals

- 60/40 for ranging markets where you want more signals

there's no "best" setting — it depends on your trading style, timeframe, and the instrument you're trading. what works on ES might not work the same on GC or RTY.

key takeaways

- RSI measures momentum, not direction — overbought doesn't automatically mean sell, and oversold doesn't automatically mean buy

- the 50 level acts as a centerline separating bullish and bearish momentum — use it as a simple trend filter

- divergence between price and RSI can signal weakening momentum, but always wait for price confirmation before trading

- RSI works best when combined with support/resistance, moving averages, and overall price action — never use it in isolation

- backtest any RSI strategy before trading it live, and adjust settings based on your timeframe and trading style

FAQs