electronic trading hours vs regular trading hours: ETH vs RTH explained for futures traders

let me be blunt... one of the biggest mistakes I see futures traders make is not understanding when their strategies actually work best.

you're probably familiar with this scenario: you backtest a strategy and it looks amazing, then you trade it live and get completely different results. or maybe you're following someone else's charts but your VWAP looks different, your opening range doesn't match, and you can't figure out why.

here's the thing... it all comes down to ETH vs RTH.

electronic trading hours (ETH) and regular trading hours (RTH) create completely different market environments. the liquidity is different, the volatility patterns change, and gaps form in ways that can either help or hurt your strategy. after working with thousands of traders, I've seen how this one concept can make or break a trading approach.

table of contents

- what are ETH vs RTH in futures?

- when do ETH and RTH run for ES, NQ, and other CME contracts?

- why ETH vs RTH matters: liquidity, spreads, volatility, and gaps

- how to choose ETH vs RTH for charts, VWAP, opening range, and backtests

- which session fits your strategy? scalps, trend days, and overnight setups

- ETH vs RTH frequently asked questions

what are ETH vs RTH in futures?

let's start with the basics because there's a lot of confusion around these terms.

- electronic trading hours (ETH) is the full session when CME futures trade electronically through the Globex system. this runs nearly 24/5, with only a brief maintenance break each day. when people say "24-hour futures trading," they're talking about ETH.

- regular trading hours (RTH) refers to the traditional cash market hours when the underlying stock indices are actively trading. for equity index futures like ES and NQ, RTH aligns with NYSE and NASDAQ cash hours.

here's where it gets interesting... RTH is actually a subset of ETH. think of ETH as the full pie, and RTH as just one slice of that pie.

the key difference? RTH coincides with when institutional stock traders, index funds, and cash equity markets are most active. ETH includes all the overnight and extended hours when futures trade but the underlying cash markets are closed.

this matters because market behavior changes dramatically between sessions. during RTH, you get the full force of institutional flow, earnings reactions, and economic data releases. during ETH (but outside RTH), you're dealing with lighter volume, different participants, and overnight positioning adjustments.

when do ETH and RTH run for ES, NQ, and other CME contracts?

let's break down the exact hours for the most actively traded futures contracts. all times are Eastern Time (ET), which is what most US futures traders use.

ES/MES (S&P 500): ETH and RTH hours

- ETH (full session): Sunday 6:00 PM - Friday 5:00 PM ET

- RTH (cash hours): Monday-Friday 9:30 AM - 4:00 PM ET

- maintenance break: Monday-Thursday 5:00 PM - 6:00 PM ET

NQ/MNQ (Nasdaq): ETH and RTH hours

- ETH (full session): Sunday 6:00 PM - Friday 5:00 PM ET

- RTH (cash hours): Monday-Friday 9:30 AM - 4:00 PM ET

- maintenance break: Monday-Thursday 5:00 PM - 6:00 PM ET

YM/MYM (Dow): ETH and RTH hours

- ETH (full session): Sunday 6:00 PM - Friday 5:00 PM ET

- RTH (cash hours): Monday-Friday 9:30 AM - 4:00 PM ET

- maintenance break: Monday-Thursday 5:00 PM - 6:00 PM ET

RTY/M2K (Russell 2000): ETH and RTH hours

- ETH (full session): Sunday 6:00 PM - Friday 5:00 PM ET

- RTH (cash hours): Monday-Friday 9:30 AM - 4:00 PM ET

- maintenance break: Monday-Thursday 5:00 PM - 6:00 PM ET

CL/MCL (crude oil): ETH and RTH hours

- ETH (full session): Sunday 6:00 PM - Friday 5:00 PM ET

- RTH (cash hours): Monday-Friday 9:00 AM - 2:30 PM ET

- maintenance break: Monday-Thursday 5:00 PM - 6:00 PM ET

notice how all equity index futures share the same ETH window, but commodities like crude oil have different RTH periods that align with their specific cash markets.

the Sunday 6:00 PM open is critical because that's when gaps can form from Friday's RTH close. if ES closed Friday at 4:00 PM at 5,800 and opens Sunday at 6:00 PM at 5,820, you've got a gap that might fill during the week.

why ETH vs RTH matters: liquidity, spreads, volatility, and gaps

here's where the rubber meets the road. ETH vs RTH creates fundamentally different trading environments, and understanding this can transform your results.

liquidity differences across sessions

during RTH, you get maximum liquidity. institutional traders are active, market makers are providing tight spreads, and there's genuine two-way flow. the average daily volume on ES during RTH typically represents about 60-70% of the total daily volume, even though RTH is only about 6.5 hours of the 23-hour trading day.

during ETH (outside RTH), liquidity drops significantly. you're dealing with overnight positioning, Asian and European participants, and algorithmic flow. spreads widen, and you can see more erratic price movements on lower volume.

volatility patterns by session

RTH volatility comes from real business. earnings announcements, economic data releases, Fed speeches, and institutional rebalancing all happen during regular hours. this creates predictable volatility spikes around 9:30 AM ET open, FOMC announcements, and key economic data.

ETH volatility often comes from positioning adjustments and overnight news. you'll see reactions to Asian markets, European economic data, or geopolitical events. but here's the catch... these moves can reverse quickly once RTH opens and institutional flow takes over.

gap mechanics and session transitions

gaps form when there's a price difference between RTH close and the next RTH open. but here's what most traders miss... the overnight ETH session is when gaps develop or get partially filled.

let's say ES closes RTH Friday at 5,800. during the Sunday night to Monday morning ETH session, it trades between 5,790-5,810. when RTH opens Monday at 9:30 AM, if ES opens at 5,810, you have a gap up. but if it opens at 5,790, you have a gap down.

understanding this sequence helps you anticipate gap fill probabilities and position size appropriately.

spread considerations for different strategies

if you're scalping, RTH typically offers tighter spreads. during peak RTH hours, ES might trade with 0.25-point spreads consistently. during overnight ETH, those spreads can widen to 0.50 points or more, especially during thin Asian hours.

for swing trading and position holding, ETH vs RTH matters less for spreads but more for entry and exit timing.

how to choose ETH vs RTH for charts, VWAP, and opening range breakouts

this is where session selection gets practical. different indicators and strategies behave completely differently depending on which session you choose.

VWAP: full session vs RTH reset

VWAP (volume weighted average price) is probably the most session-sensitive indicator I know.

- full session VWAP (ETH) includes all overnight volume and starts fresh at Sunday 6 PM ET. this gives you the "true" average price weighted by all volume, but it can be skewed by thin overnight trading.

- RTH VWAP resets at 9:30 AM ET every day and only includes regular trading hours volume. this aligns with institutional VWAP calculations and tends to be more relevant for day trading strategies.

which should you use? if you're day trading and want to align with institutional order flow, RTH VWAP is usually better. if you're trading overnight or holding positions across sessions, full session VWAP gives you the complete picture.

opening range: ETH vs RTH definitions

the opening range breakout (ORB) strategy doesn't change at all depending which method you choose for calculation, because the ORB is usually the first 15-30 minutes of the NY session open.

this captures the initial reaction to overnight news and sets up breakout trades based on cash market participation.

volume profile: session-specific analysis

volume profile changes dramatically between sessions. RTH volume profile shows you where institutions are comfortable buying and selling. ETH volume profile (especially overnight) shows more algorithmic and positioning activity.

for day trading, RTH volume profile typically provides better support and resistance levels. for swing trading across multiple days, combining RTH and ETH volume data gives you a more complete picture.

which session fits your strategy? scalps, trend days, and overnight setups

different trading strategies work better in different sessions. let's break this down by approach.

RTH focus: cash open drives and institutional flow

- opening range breakouts work best during RTH because that's when you get the institutional participation needed to sustain breakout moves. the first 30 minutes of RTH often sets the tone for the entire day.

- economic data reactions happen during RTH (mostly). FOMC announcements, NFP releases, and major earnings all create their biggest moves during regular hours when institutional flow amplifies the reactions.

ETH focus: overnight mean reversion and positioning

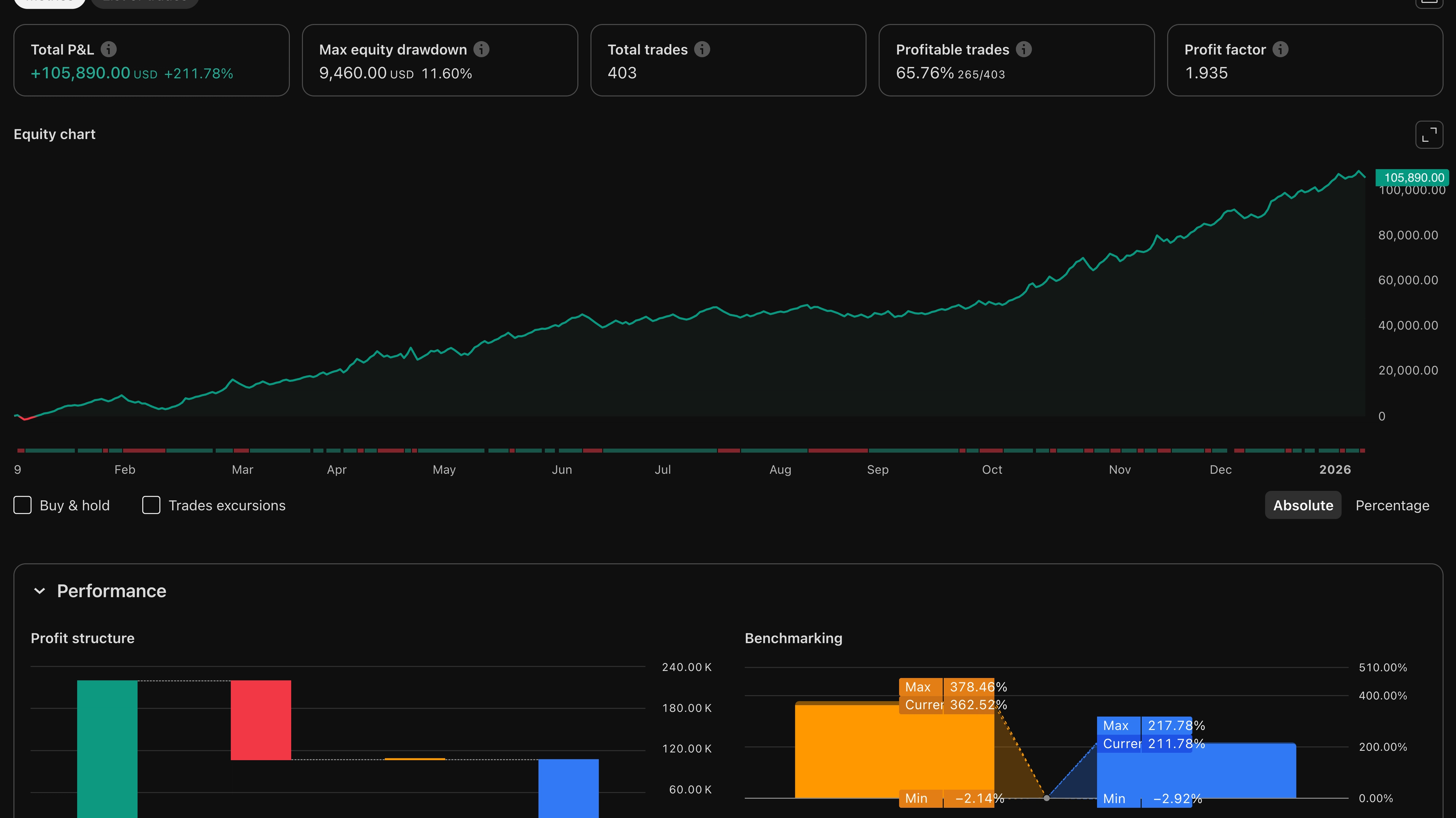

one key level that we follow at edgeful (and outlined in our 3-minute morning routine blog) is the ICT midnight open.

with this strategy, we're checking how often price retraces back to the midnight open (formed during the ETH trading hours). and, based on the data, this happens about 65% of the time on YM over the last 6 months.

here's the edgeful report data:

Sunday open: gap risk and opportunity

the Sunday 6 PM ET open creates unique opportunities and risks. gaps from Friday's RTH close often provide high-probability setups, but you need to understand the dynamics.

- gap fill probability varies by size. smaller gaps (under 10 ES points) tend to fill more frequently than larger gaps. but this also depends on the underlying news and positioning.

electronic trading hours vs regular trading hours frequently asked questions

is ETH the same as extended hours?

not exactly. ETH (electronic trading hours) is the official CME term for the full Globex trading session. "extended hours" is more commonly used in stock trading and can refer to pre-market and after-hours sessions. for futures, ETH is more precise and comprehensive.

should I use ETH or RTH for micro futures trading?

micro futures (MES, MNQ, MYM, M2K) follow the same ETH vs RTH patterns as their full-size counterparts. the choice depends on your strategy, not the contract size. however, micros can have even thinner liquidity during ETH sessions, so RTH might be more suitable for active trading.

do gaps only refer to RTH sessions?

gaps typically refer to the difference between RTH close and RTH open, but they can form during any session break. the most significant gaps happen over weekends (Friday RTH close to Monday RTH open) and around holidays when markets are closed for extended periods.

how do I avoid confusion between ETH and Ethereum?

this is actually a common search problem. when researching "ETH trading hours," you might get Ethereum cryptocurrency results. always use "electronic trading hours" or "ETH futures" in your searches to get relevant futures trading information.

which session gives better risk-adjusted returns?

this depends entirely on your strategy and risk management. RTH typically offers better liquidity and tighter spreads, which can improve risk-adjusted returns for scalping and day trading. ETH can offer better risk-adjusted returns for specific overnight strategies, but position sizing needs to account for wider spreads and lower liquidity.

key takeaways for futures traders

after working with thousands of futures traders, here are the essential points about ETH vs RTH:

- session selection impacts everything - your VWAP calculations, opening range definitions, volume profile analysis, and backtest results all change based on session choice. don't switch randomly between sessions expecting consistent results.

- match your session to your strategy - RTH works better for institutional flow-based strategies, economic data plays, and opening range breakouts. ETH works better for overnight positioning, gap trading, and certain mean reversion approaches.

- liquidity matters more than you think - the spread and liquidity differences between ETH and RTH can significantly impact your transaction costs and slippage, especially on smaller account sizes.

- gaps create opportunities - understanding how gaps form during session transitions gives you an edge in positioning for gap fill or gap extension plays.

the bottom line? ETH vs RTH isn't just a technical detail... it's a fundamental part of developing and executing profitable futures trading strategies.

most traders I work with find success by picking one primary session and mastering it completely before trying to trade across multiple sessions. whether you choose ETH or RTH, consistency in your approach will serve you better than constantly switching between sessions.

want to get these insights delivered weekly? join thousands of traders getting our stay sharp newsletter with actionable market analysis and strategy updates.