the PDT rule explained: what every trader needs to know in 2025

I've talked to thousands of traders over the years, and there's one regulation that trips up more new traders than anything else: the PDT rule.

if you're starting out with less than $25,000 in your trading account, you need to understand this rule inside and out. because ignoring it? that's a fast track to getting your account restricted for 90 days.

the pattern day trader rule affects millions of retail traders, yet most don't fully grasp how it works until they're already flagged. whether you're just getting started or you've been trading for a while, understanding the PDT rule is crucial for your success.

table of contents

- what is the PDT rule and why it exists

- who does the pattern day trader rule affect

- the $25,000 minimum explained

- what counts as a day trade

- consequences of getting flagged as a pattern day trader

- smart strategies for trading under $25k

- how to avoid PDT restrictions in 2025

- frequently asked questions

what is the PDT rule and why it exists

the pattern day trader rule is a FINRA regulation from 2001 that requires anyone making 4+ day trades within 5 business days to maintain at least $25,000 in their margin account.

this PDT rule came about after the dot-com bubble burst, when regulators saw too many retail traders blowing up their accounts through excessive day trading. the goal was simple: protect traders from themselves and reduce systemic risk in the markets.

the definition breakdown

pattern day trader: someone who executes 4+ day trades in 5 business days in a margin account

pattern day trader rule: the specific $25,000 minimum equity requirement that applies to these traders

day trading: buying and selling the same security within the same trading day

I get why this PDT rule frustrates new traders. what most people don't realize is that it actually came from trying to protect retail traders from making costly mistakes when they don't have enough capital to absorb losses.

who does the pattern day trader rule affect

the PDT rule doesn't affect everyone equally.

affected traders:

- retail traders with margin accounts under $25k

- new traders starting with limited capital

- active intraday traders making frequent trades

- anyone attempting to day trade stocks, ETFs, or options

not affected:

- cash account traders (but with settlement restrictions)

- futures traders (this is key...)

- institutional traders

- accounts over $25,000

most new traders fall into that first category — they start with a few thousand dollars, open a margin account thinking they'll have more buying power, and quickly run into PDT rule restrictions.

that's actually one reason why many of our traders at edgeful focus on futures — no PDT restrictions, but that's a whole other conversation we'll get into later.

cash accounts are technically exempt from the PDT rule, but you'll face T+2 settlement periods. that means when you sell a stock, you have to wait two business days before you can use those funds again. it's like trading with one hand tied behind your back.

the $25,000 minimum explained

what regulators were thinking back in 2001 when they set this threshold...

the $25,000 minimum exists for several reasons:

- frequent trading increases risk exponentially

- provides a cushion for potential losses from multiple trades

- reduces broker liability and systemic risk

- reflects the capital needed to weather typical day trading drawdowns

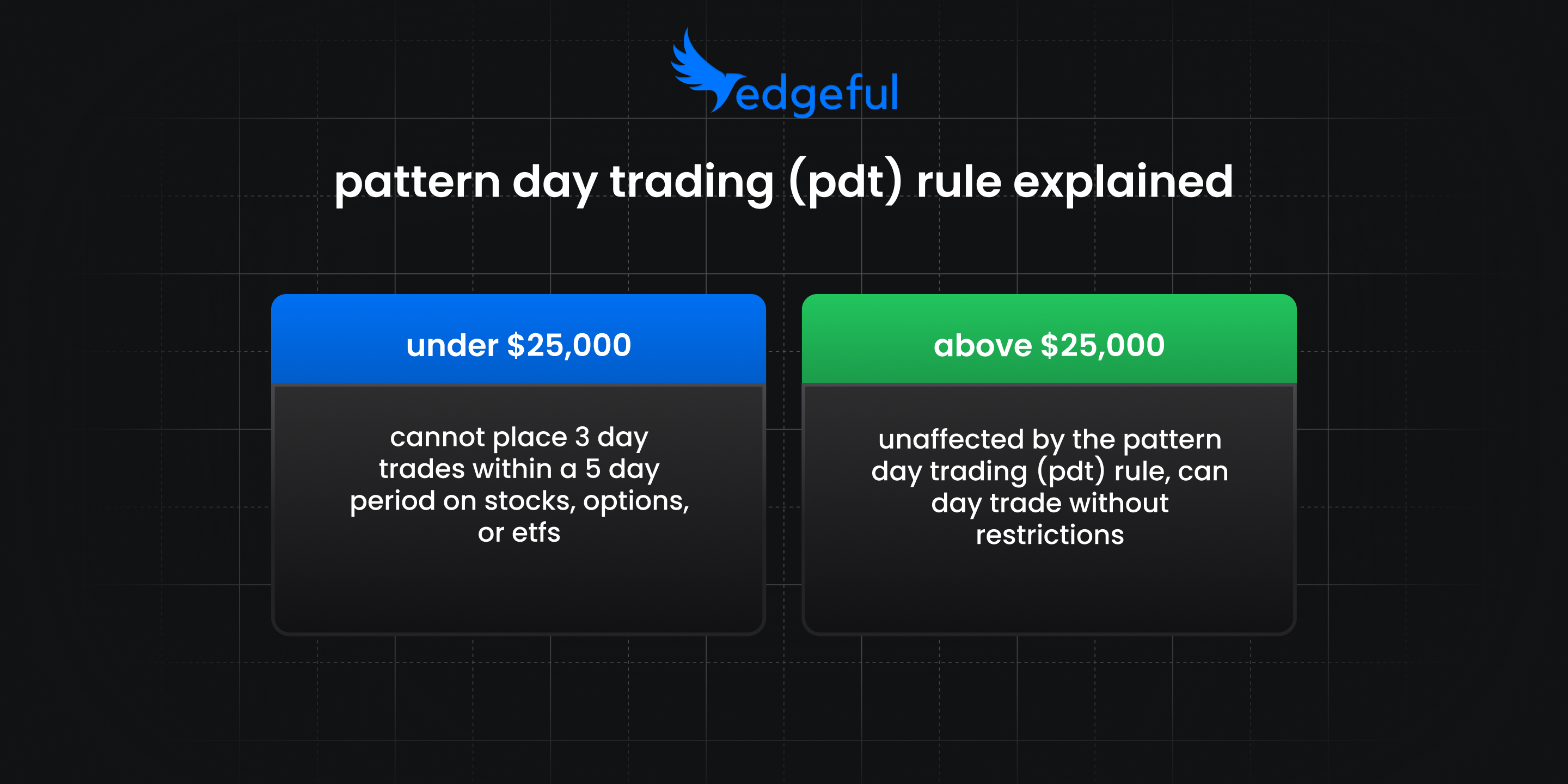

the PDT rule essentially creates two classes of traders. those with $25,000+ can trade as much as they want, while everyone else gets severely limited.

from a risk management perspective, $25,000 was chosen as the threshold because historical data showed that traders with less capital had significantly higher account blow-up rates. the reasoning was that if you can't afford to lose $25,000, you probably shouldn't be day trading.

what counts as a day trade

this trips people up constantly...

a day trade is buying and selling (or selling short and buying to cover) the same security on the same trading day in a margin account.

classic day trade examples:

- buy 100 shares AAPL at 10am, sell at 2pm same day ✓

- short 200 shares TSLA at open, cover at close ✓

- buy SPY calls at 9:45am, sell at 11:30am ✓

- buy QQQ shares pre-market, sell during regular hours ✓

NOT day trades:

- buy Monday, sell Tuesday (different days)

- buy in cash account (PDT rule doesn't apply)

- sell first, buy back next day

- hold positions overnight then close next day

the PDT rule is strict about the definition. if you open and close a position on the same trading day, it counts as a day trade. period.

I've seen traders think they're being clever by closing positions after hours... nope, still counts if it's the same trading day. extended hours trading (pre-market and after-hours) is still considered part of that trading day for PDT rule purposes.

partial fills and the PDT rule

this is where it gets tricky. if you buy 200 shares of a stock in the morning, then sell 100 shares in the afternoon and another 100 shares later, that counts as ONE day trade, not two. the PDT rule looks at your net position changes, not individual transactions.

but if you buy 100 shares, sell those 100 shares, then buy another 100 shares and sell those same day... that's two separate day trades.

consequences of getting flagged

when you exceed the PDT rule threshold without having $25,000 in your account, the consequences hit immediately:

immediate consequences:

- account restriction to closing positions only

- 90-day restriction period

- must deposit funds to reach $25k minimum to lift restrictions

- potential one-time flag removal (broker dependent)

step-by-step what happens:

- your broker's system automatically flags the account

- you receive notification (email/platform alert) about PDT status

- account becomes "close only" - you can exit positions but not open new ones

- restriction lasts 90 days unless you deposit enough to reach $25k

one of our community members thought they were tracking trades correctly, made that fourth day trade on a Friday afternoon, and boom - account restricted until they could deposit more funds. they had to sit out a massive earnings season because of one miscounted trade.

most brokers will give you ONE free PDT flag removal as a courtesy, but policies vary. some require you to call within 24 hours, others give you more time. once you use that get-out-of-jail-free card though, you're on your own.

the PDT rule restriction isn't just inconvenient - it can be financially devastating if you get flagged during high-volatility periods when trading opportunities are abundant.

smart strategies for trading under $25k

if you're working with limited capital, your best options...

strategy 1: cash account approach

switching to a cash account completely avoids the PDT rule, but comes with tradeoffs:

- no PDT restrictions whatsoever

- settlement periods apply (T+2 for stocks)

- requires patience and careful planning

- limits your trading frequency naturally

cash accounts work well for swing trading strategies where you're holding positions for days or weeks rather than hours.

strategy 2: three trades max strategy

stay under the 4-trade PDT rule threshold by limiting yourself to 3 day trades every 5 business days:

- focus on high-probability setups only

- quality over quantity approach

- requires disciplined trade selection

- maximize each trade's profit potential

when you only get 3 day trades every 5 days, you better make them count. this is where having data-driven strategies becomes crucial for identifying the highest probability setups.

strategy 3: futures trading

futures contracts aren't subject to the PDT rule because they're regulated by the CFTC, not the SEC:

- no PDT restrictions at all

- lower margin requirements than stocks

- nearly 24-hour trading sessions

- high liquidity in major contracts

many traders struggling with the PDT rule find futures trading liberating. you can make as many round trips as you want without worrying about arbitrary restrictions.

[Image placeholder: Comparison chart showing trading flexibility between stocks under PDT rule vs futures trading]

strategy 4: multiple brokers

some traders open accounts at multiple brokers to effectively get 3 day trades at each broker. technically this doesn't violate the PDT rule since each account is separate, but it requires more capital and careful tracking.

this approach works but adds complexity. you'll need to manage multiple platforms, track positions across accounts, and ensure you have enough buying power at each broker.

the futures advantage for PDT rule avoidance

since futures fall under CFTC regulation rather than SEC/FINRA rules, they're completely exempt from the PDT rule.

futures benefits:

- unlimited day trading regardless of account size

- lower margin requirements than stocks

- nearly 24-hour trading opportunities

- high liquidity in major markets (ES, NQ, YM, RTY)

i've worked with plenty of traders who switched to futures specifically to avoid PDT rule headaches. it's not for everyone, but it's worth understanding your options.

futures trading does require learning different contract specifications, margin requirements, and market dynamics. but for active traders frustrated by PDT rule limitations, it can be a game-changer.

many successful day traders focus exclusively on futures markets. the E-mini S&P 500 (ES) alone provides more trading opportunities than most traders can handle, without any PDT rule restrictions.

if you're interested in systematic approaches that work well with futures, check out our guide on automated trading strategies that can help maximize your trading efficiency.

navigating PDT restrictions in 2025

staying compliant while maximizing your trading potential...

modern approaches:

- broker-provided PDT tracking tools and alerts

- automated trade counting systems

- focus on data-driven setups for limited trades

- algorithmic approaches for trade efficiency

2025 market considerations:

- increased volatility creates bigger opportunities with fewer trades

- better data access for superior trade selection

- improved broker tools and real-time notifications

- AI-assisted trade setup identification

the landscape has changed dramatically since the PDT rule was implemented. traders today have access to much better data and tools to make those limited day trades really count.

technology solutions

modern trading platforms offer sophisticated PDT rule tracking:

- real-time day trade counters

- automated alerts before reaching limits

- pattern recognition for high-probability setups

- risk management tools for position sizing

instead of manually tracking trades, let technology handle the compliance while you focus on finding the best opportunities. this is especially important when you're limited to just 3 day trades per 5-day period.

data-driven trade selection

when you can't trade frequently, each trade needs to count. this is where understanding why futures traders fail becomes relevant - emotional trading becomes even more costly when you have limited opportunities.

successful PDT rule navigation requires:

- statistical edge identification

- proper position sizing relative to account

- clear entry and exit criteria

- emotional discipline for limited trades

you can't afford to waste day trades on mediocre setups or emotional decisions.

frequently asked questions

is day trading illegal if you have less than $25,000?

no, day trading isn't illegal with less than $25k. the PDT rule simply limits you to 3 day trades every 5 business days in margin accounts to avoid restrictions. you can still day trade, just with limitations.

what happens if i make a fourth day trade while under $25k?

your account gets flagged as a pattern day trader and restricted to closing positions only for 90 days or until you deposit enough to reach the $25k minimum. this PDT rule enforcement is automatic and immediate.

can i reset my pattern day trader status?

most brokers offer a one-time PDT flag removal as courtesy, but policies vary significantly. contact your broker directly to ask about resetting your status. after using this one-time removal, you won't get another chance.

does the PDT rule apply to cryptocurrency trading?

generally no - the PDT rule doesn't apply to cryptocurrency since most crypto exchanges aren't FINRA regulated. however, individual platforms may have their own trading restrictions, so always check the specific exchange's policies.

are there any exceptions to the PDT rule?

there are no formal exceptions to the PDT rule itself, but you can avoid it by using cash accounts, trading futures contracts, or maintaining the $25,000 minimum. these aren't exceptions - they're different regulatory frameworks entirely.

key takeaways

what you need to remember about the PDT rule...

- 4+ day trades in 5 business days triggers pattern day trader status

- $25k minimum equity required for unlimited day trading in margin accounts

- cash accounts avoid the PDT rule but have T+2 settlement restrictions

- futures trading offers complete exemption from PDT rule limitations

- quality over quantity becomes essential when limited to 3 day trades

- modern technology can help maximize success within PDT constraints

- one-time flag removals are available but policies vary by broker

the PDT rule doesn't have to end your trading career. understanding how it works and planning accordingly can help you navigate these restrictions while building your account toward that $25,000 threshold.

whether you choose to work within the PDT rule constraints, switch to cash accounts, or explore futures trading, the key is having a clear plan and sticking to it. don't let regulatory restrictions derail your trading goals - adapt your strategy and keep moving forward.

for more insights on developing winning trading strategies that work within regulatory constraints, visit our main trading blog for data-driven approaches that actually work.

want more data-driven trading insights delivered to your inbox?

our stay sharp newsletter breaks down complex trading concepts with real data and examples. no hype, no fluff - just practical insights you can actually use.