how to use edgeful's 3 algo trading strategies for consistent profits

why emotional trading is destroying your account

we've all been there. you enter a trade based on a solid setup, but the second it goes against you by a few points, you panic and exit... only to watch it reverse and hit your original target without you.

or maybe you hold onto a loser way too long because you "just know" it's going to come back... and instead of taking a small loss, you end up with a drawdown that ruins your week in a matter of minutes.

the emotional trading cycle

here's the emotional trap most traders find themselves stuck in:

- you enter a trade based on a setup you think works

- it goes against you, triggering fear or hope

- you make a decision based on that emotion, not your original plan

- your results suffer

- you lose confidence in your strategy

- you start looking for a new strategy... and the cycle repeats

I've seen this pattern play out with thousands of traders. what's wild is that many of them have actually found solid strategies that would work if they could just stick to them consistently.

but they can't... because emotions get in the way every single time.

think about it — when was the last time you stuck perfectly to your trading plan for an entire week? if you're like most traders, it's probably been a while.

introducing edgeful's algo trading strategies

after years of building data-driven reports and helping traders use these reports to trade with confidence, we're ready for the next step: edgeful algos.

each algo is based on the same data we've been showing you in our reports for years, but instead of you having to interpret that data and execute manually, the algo does it for you.

imagine if every single day, you knew exactly:

- which strategy to trade

- precise entry points with clear triggers

- where to place your stops

- where to take profits

and most importantly — imagine having the confidence to follow through on every signal because you've seen the historical performance data that proves it works.

that's exactly what our algo trading strategies deliver.

the three core algo trading strategies

we've built algos for the three most popular edgeful reports:

- the gap fill strategy — based on our gap fill report data

- the opening range breakout (ORB) strategy — based on our ORB report

- the initial balance (IB) strategy — based on our IB report

we've done extensive work with the data to give you:

- data-backed entries

- data-backed profit targets

- data-backed stop loss levels

the algo plots everything automatically on TradingView charts and sends alerts straight to your phone and computer. no more second-guessing, no more emotional decisions, just clear signals that you can customize to fit your trading style.

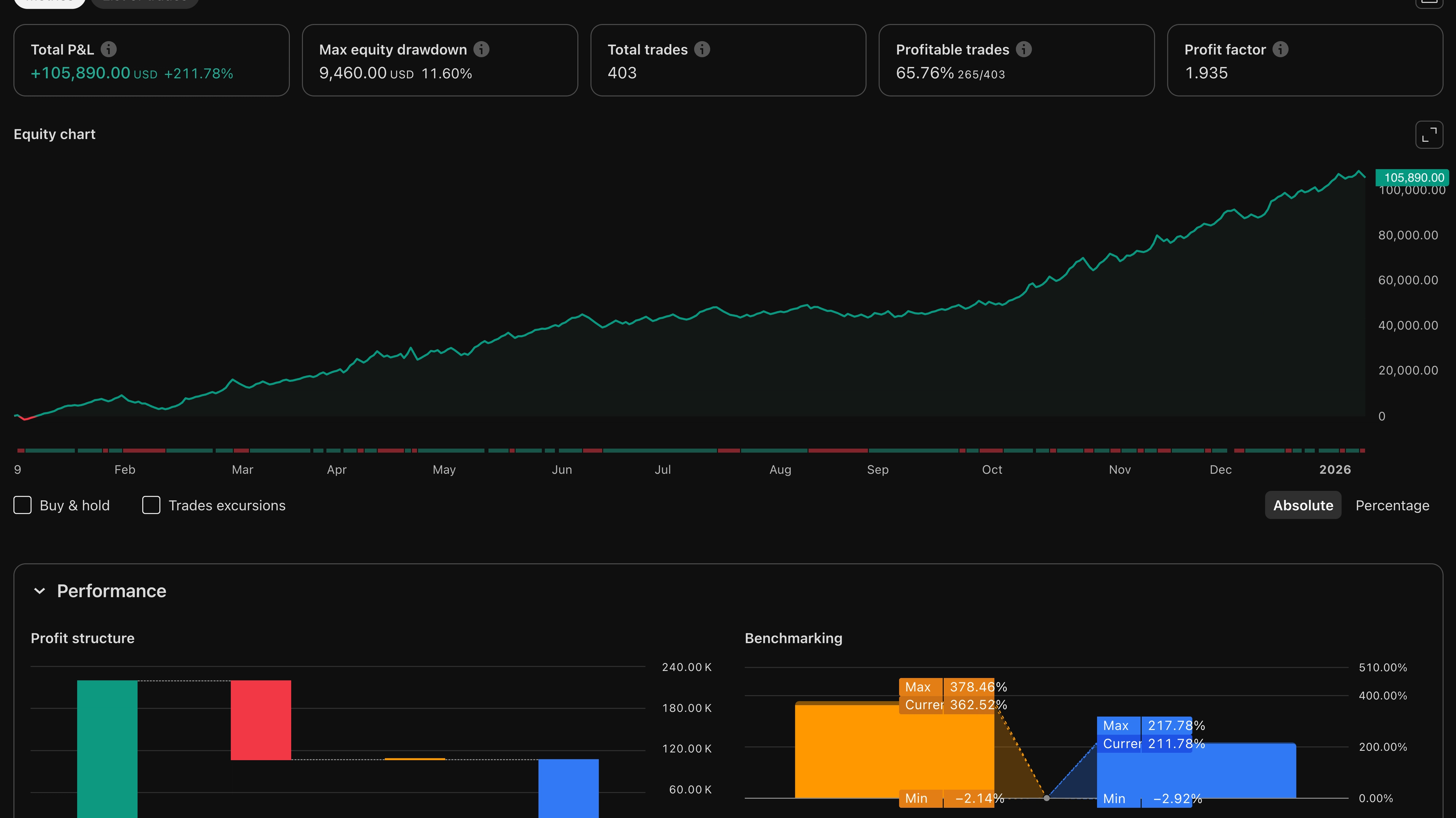

real-world performance of our algo trading strategies

I've been testing these algos extensively over the past 18 months, and the results speak for themselves.

on ES, using the default settings on one of our algos, the total P&L return was almost $25,000 on a $10,000 account — that's 250% in the last 7 months.

to put that in perspective, that's enough to:

- easily pass even the strictest funded trader challenges

- get multiple payouts on funded accounts

- completely transform a personal trading account

and that's without any optimization or customization — just the default settings right out of the box.

example of an algo trading strategy in action

here's what a winning trade looks like:

notice how there's no ambiguity, no gray areas. the algo tells you exactly where to:

- enter

- exit

- take profits

simple, effective, and incredibly easy to follow with alerts sent right to your phone... no emotions involved.

when you run the algo backtester, you'll also get a list of every single trade that went into the performance calculation, making it super easy to study the patterns with your own eyes.

customization options for your algo trading strategy

the best part of these algos is that while they outperform the market with just the default settings, you can also customize them to fit your trading style.

want to focus on a higher win rate? you can adjust for that. prefer a higher profit factor? you can customize for that too. have specific risk parameters? you can set your max loss per trade.

everything is customizable, including:

- risk type

- max loss per trade

- trading different days of the week

- risk ratio

- stop loss levels

- entry confirmation criteria

- trailing stop parameters

- session times

and if we're missing any customizations, you can reach out directly to our support and we'll work on getting what you need pushed out ASAP.

the impact of algo trading on consistency

let's be honest about something...

the difference between consistently profitable traders and everyone else isn't that they have some secret indicator or magical setup.

it's that they have the discipline to follow their strategy day in and day out — without tilting when they hit a losing streak or without oversizing and taking on too much risk when on a winning streak.

this is what our algo trading strategies will do for you — provide you with the discipline to follow every signal, take every trade without fear, and execute consistently.

and that consistency is what creates:

- steadily growing equity curves instead of wild swings

- confidence to size up when appropriate

- the ability to compound your gains over time

- peace of mind that you're not gambling, you're trading

real results from real traders

the performance speaks for itself, and many members in our community have already started passing funded challenges and making real money using these algo trading strategies.

getting started with edgeful's algo trading strategies

ready to stop trading with emotions and start trading with data? here's how to get started:

- sign up for edgeful algos access

- connect your TradingView account

- add the algos to your charts

- set up your alerts

- follow the signals consistently

for years, I've been saying you need to trade with data, not emotions. these algo trading strategies are the next step for traders who are ready to make the switch.

conclusion

let's do a quick recap of what we covered today:

- emotional trading creates inconsistent results and blown accounts

- how our algo trading strategies eliminate emotions from your trading

- the algos give you precise entries, exits, and stop levels

- the default settings on all 3 algos widely outperform the ES, NQ, and YM

- you can customize everything to fit your trading style

if you're ready to stop trading with emotions and start seeing consistent results, check out our algo trading strategies today.