engulfing candle algo: new automated trading strategy

welcome back to another edition of stay sharp.

I've covered the engulfing bars report before — and how to use the by RR report to build a data-backed strategy.

well, here's the next evolution: our engulfing candle algo.

table of contents

- why manual execution fails even when you know the data

- how the engulfing candle algo executes your strategy perfectly

- real backtest results that will surprise you

- optimization, then automation

- ready to automate the engulfing candles

by the end of today, you'll know:

- why manual execution fails even when you know the data

- how the engulfing candle algo executes your strategy perfectly

- real backtest results that'll make you question manual trading forever

- the optimization process that turns good results into exceptional ones

- how to get access and automate your edge

let's get started:

the data behind the engulfing candles

before we get into the strategy itself, let's get a quick refresher on what an engulfing candle is.

the body of the current candle completely engulfs the body of the previous candle.

bullish engulfing occurs when:

- the current candle opens at or below the previous candle's close

- closes above the previous candle's open

- is green (close > open)

- the previous candle is red (open > close)

bearish engulfing occurs when:

- the current candle opens at or above the previous candle's close

- closes below the previous candle's open

- is red (close < open)

- the previous candle is green (open < close)

here's how the engulfing candle setup works:

for bullish engulfing candles:

- enter long at the close of the engulfing candle

- place your stop loss at the low of the engulfing candle

for bearish engulfing candles:

- enter short at the close of the engulfing candle

- place your stop loss at the high of the engulfing candle

with the strategy above — we've got entry and stop loss taken care of. but how do you use data to build take profit levels?

that's where the engulfing by RR report comes in.

by using this report, you get concrete stats on how likely it is for engulfing patterns to actually follow through to different profit targets. if you want to read more about that report, check out our detailed analysis of engulfing bars trading strategy.

here's what the data says on ES for the engulfing candle by RR report:

- bullish engulfing: ~70% of the time it hits 0.5RR, and ~40% of the time it hits 1.0RR

- bearish engulfing: ~52% of the time it hits 0.5RR, and ~35% of the time it hits 1.0RR

so now we have:

- entry level (engulfing candle close)

- exit level (the high/low of the engulfing candle)

- two data-backed take profit levels

you've got an entire strategy...

but here's the problem: can you execute it perfectly every time?

can you:

- catch every qualified engulfing candle setup during market hours?

- enter exactly at the candle close without hesitation?

- set your stop at the exact high or low of the engulfing candle?

- take profits at your predetermined RR target without getting greedy or scared?

most importantly — can you do this for weeks, months, or years without letting emotions creep in?

this is where 99% of traders fail. they have the strategy, they know the probabilities, but they can't execute consistently. they miss signals because they're away from their screen. they hesitate on entries because "this one looks different." they move their stops because "just give it a little more room this time."

the engulfing candle algo solves this completely. it takes every signal based on your exact inputs. no emotions, no hesitation, no missed opportunities.

this addresses the core issue we covered in why futures traders fail — the gap between having an edge and executing it consistently.

how the algo executes your strategy

the algo doesn't reinvent engulfing candle patterns — it perfects the execution of what you already know works.

here's exactly how it works:

entry mechanics: the algo enters long or short at the exact close of the engulfing candle. at most there will be 1-2 seconds of latency between when the signal fires from TradingView and when the order executes on your broker.

stop management: this is where the automated strategy changes from the manual one. with the algo, you can set your stop loss at any % of the engulfing candle, OR you can set a max $ value loss per contract — and this will always override the percentage-based stop. it'll only exit once that value is reached.

the point is: you can customize your algo to fit your personality and own risk tolerance.

trade discipline: the algo follows strict rules you can't break emotionally. only one trade at a time — no revenge trading or doubling up. no entries on the first candle of the session (nothing to engulf). no entries on the last candle (you'd have to exit immediately).

profit targets: you set your take profit as a percentage of the engulfing candle size. want to target 0.5R like the data suggests? set it to 50%. want to test 1R? set it to 100%. the algo hits your target and moves on — looking to trade the next engulfing candle.

that's one of the cool things about this new algo — it's the first one that can take multiple trades throughout the day. perfect for traders who want a little more activity during the session.

this systematic approach is part of a comprehensive automated trading strategies framework that removes human error from proven setups.

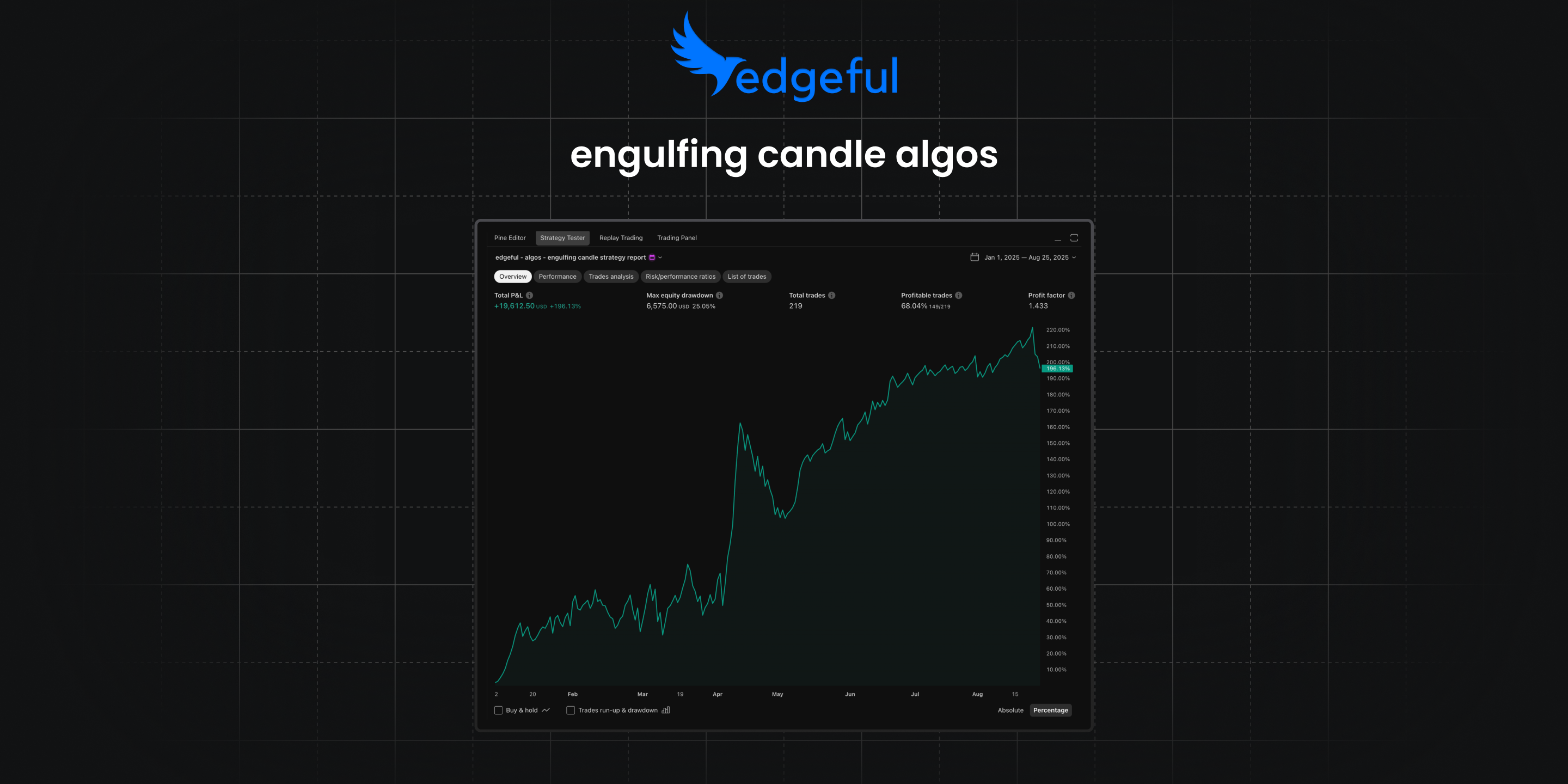

the backtest results that will surprise you

before anything else, let's talk about how the algo has performed this year. here are the real backtest results from ES on the 30-minute timeframe, from 2023 until August 25th, 2025:

out-of-the-box performance:

- 237%+ returns

- 27% maximum drawdown

- 66% win rate

- 1071 total trades

- 1.126 profit factor

remember — these results include the raw, unoptimized version. when you dig into the data (which I'll show you how to do), you discover certain patterns that consistently lose money.

without giving away the specific findings, let me just say this: there are particular weekdays and directions that drag down performance significantly. when you identify and remove these losing patterns, the results improve dramatically:

- 240%+ returns YTD

- 23% maximum drawdown (lower than before)

- still 200+ trades (plenty of opportunities)

- 70%+ win rate maintained

- 1.6 profit factor

and here's the counterintuitive discovery that surprised me: giving trades slightly more room to breathe with a higher max loss actually improved performance. traders instinctively want tight stops, but sometimes you're choking your winners by being too restrictive.

these results build on what we established with top TradingView indicators for futures trading, but automated execution takes it to the next level.

optimization, then automation

here's the process that turns good results into exceptional ones:

- first, find your losing patterns. the algo provides detailed trade logs you can analyze in excel. you'll discover which weekdays, directions, or market conditions consistently lose money. I show you exactly how to do this analysis in the setup video.

- remove the worst performers. once you identify the patterns dragging down performance, you simply turn them off in the algo settings. no more wednesday shorts if they're consistent losers. no more friday longs if they don't work for your ticker.

- fine-tune your risk management. test different max loss amounts to find the sweet spot between protecting capital and giving trades room to work. sometimes slightly higher stops deliver better overall performance.

- then let it run. this is the crucial part — once you've optimized based on historical data, you let the algo execute your strategy without interference. no overriding trades because "this one looks different." no pausing the algo because you're having a bad week.

the goal is to capture every edge the data provides without the emotional interference that destroys manual trading.

if you want to see the exact analysis process I use to identify losing patterns and optimize performance, I walk through the entire methodology step-by-step in the algo setup video. but for it to matter to your trading — you'll need access to the algos.

frequently asked questions

what is an engulfing candle pattern?

an engulfing candle occurs when the current candle's body completely engulfs the previous candle's body. bullish engulfing happens when a green candle body engulfs a red candle body, often signaling potential upward reversal. bearish engulfing is the opposite pattern.

how does the engulfing candle algo work?

the engulfing candle algo automatically identifies engulfing patterns and executes trades based on your predetermined rules. it enters at the engulfing candle close, places stops at the candle high/low, and manages positions according to your risk parameters without emotional interference.

what makes automated engulfing candle trading better than manual execution?

automated execution eliminates human errors like missed signals, hesitation on entries, emotional exit decisions, and inconsistent stop placement. the algo executes every qualified setup with identical precision, capturing edges that manual traders often give back through execution mistakes.

can beginners use an engulfing candle algo successfully?

while beginners can use the algo, understanding basic candlestick patterns and risk management is essential. the automated system handles execution, but you still need to set appropriate position sizes and optimization parameters based on your account size and risk tolerance.

how do I optimize the engulfing candle algo for better performance?

optimization involves analyzing trade data to identify losing patterns, then removing those systematic losers from your settings. this includes eliminating certain weekdays, adjusting max loss amounts, and fine-tuning profit targets based on actual performance rather than theoretical expectations.

ready to automate the engulfing candles

let's recap what we covered today:

- manual execution fails even when you know the probabilities

- the engulfing candle algo executes the exact strategy from Stay Sharp 34 perfectly

- real backtest results show 200%+ returns with 70%+ win rates

- optimization removes losing patterns and improves performance further

- automation captures every edge without emotional interference

you already know engulfing candle patterns work from the data. you know the probabilities, the timeframes, and the profit targets. the question isn't whether the edge exists — it's whether you can execute it consistently.

the engulfing candle algo is the next evolution of data-driven trading. it takes everything you learned about engulfing patterns and executes it perfectly, every single time.

remember — having an edge is worthless if you can't execute it consistently. the market doesn't care what you know — it only rewards what you actually do.