sentiment analysis trading: read market bias like a pro

every morning, you wake up and ask the same question: "what's the market bias today?"

most traders figure this out by checking a single chart, reading news headlines, going with their gut feeling, or looking at futures overnight.

here's the problem with that approach... you're making a decision based on incomplete data.

sentiment analysis trading changes everything by giving you data-driven market bias instead of emotional guesswork.

table of contents

- what is sentiment analysis trading?

- the daily problem every trader faces

- how sentiment analysis trading works: three market scenarios

- bullish market sentiment (65%+ green)

- bearish market sentiment (65%+ red)

- neutral/choppy market sentiment

- the data behind sentiment analysis trading

- how to use sentiment analysis in your daily trading routine

- why sentiment analysis trading matters for day traders

- getting started with sentiment analysis trading

- frequently asked questions about sentiment analysis trading

what is sentiment analysis trading?

sentiment analysis trading is a systematic approach to determining market direction by aggregating bullish and bearish signals across multiple assets and proven trading strategies.

instead of relying on single indicators or emotions, sentiment analysis trading uses live data from major market movers to give you clear directional bias before you open any position.

this approach solves one of the biggest problems traders face: knowing whether to be bullish, bearish, or sit on your hands on any given day.

the daily problem every trader faces

I've watched thousands of traders fight bullish days trying to short tops. I've also seen them go long when everything is screaming bearish.

they wonder why they keep losing money when the answer is right in front of them: they're trading against the market instead of with it.

as we covered in our analysis of why futures traders fail, the biggest mistake is trading with emotions instead of data.

sentiment analysis trading eliminates this problem by providing objective market bias based on what the data actually shows, not what you think or feel about the market.

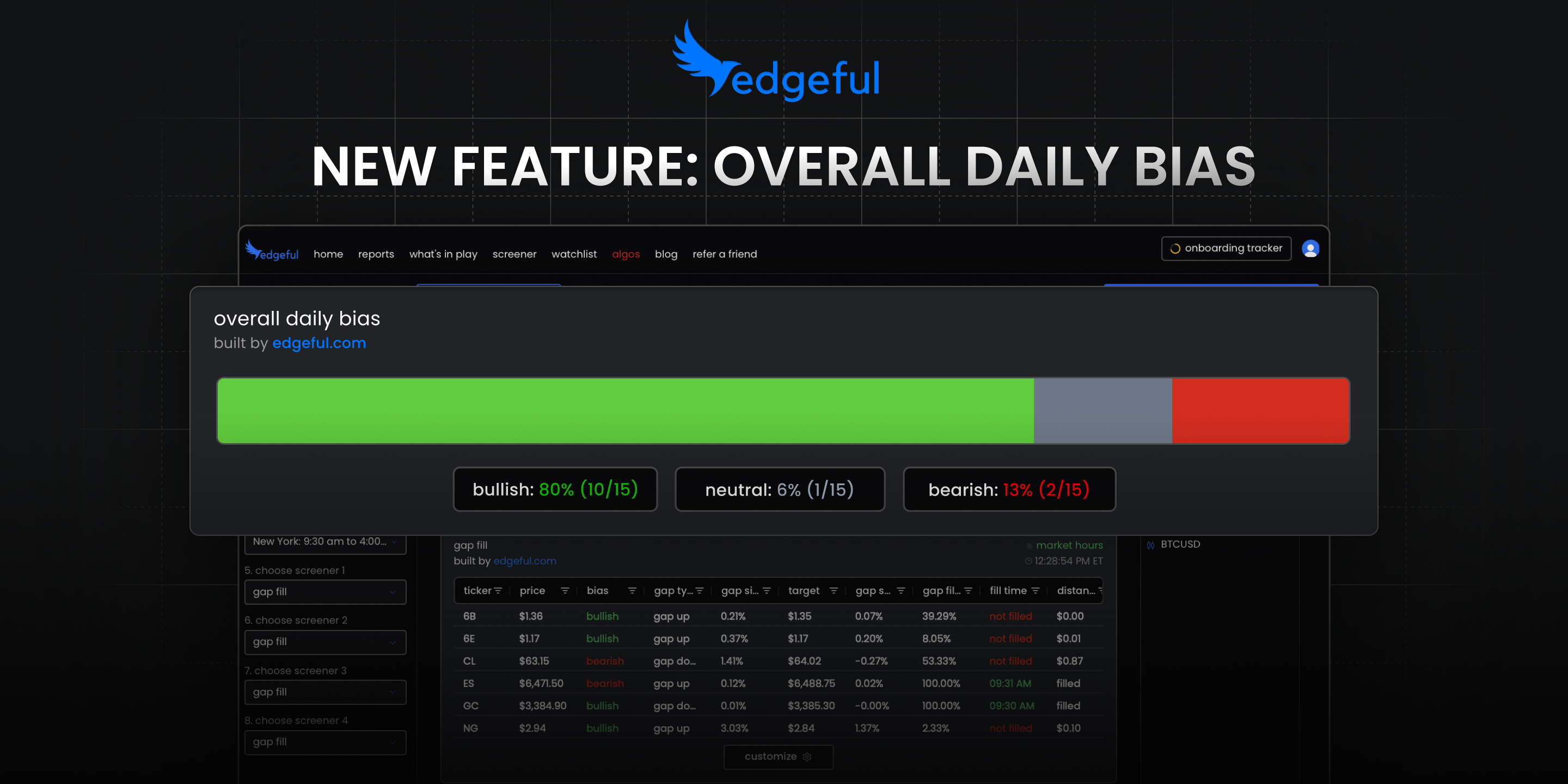

the overall daily bias bar aggregates sentiment across major tickers to provide instant market bias analysis

how sentiment analysis trading works: three market scenarios

sentiment analysis trading gives you one of three clear readings every day. let me show you exactly what each one means and how to trade them.

bullish market sentiment (65%+ green)

when sentiment analysis shows 65% or more bullish signals, the data is telling you:

- stay with the trend

- look for long setups on individual tickers

- avoid shorting against the momentum

this is what a trending bullish day looks like in sentiment analysis trading. when 12+ out of your 16 selected tickers are showing bullish bias across multiple proven strategies, you don't fight it.

you go with it.

bearish market sentiment (65%+ red)

when sentiment analysis trading shows predominantly red signals:

- look for short opportunities

- avoid buying dips and stick with the major trend of the day

- don't try to catch falling knives

this is a trending bearish day in sentiment analysis. the data is clear. when the majority of your screener shows bearish bias, you follow the data instead of fighting it.

neutral/choppy market sentiment

this is the most important scenario to recognize in sentiment analysis trading...

when you see half green, half red, or a combination with many assets showing "neutral" — that's your sign that there isn't a clear direction in the market that day.

no clear direction in sentiment analysis = that's exactly what leads to choppy days.

on these days you should:

- reduce position sizes

- take profits faster

- or just stay out completely

again — no emotion, just using sentiment analysis trading data to guide your decisions.

the data behind sentiment analysis trading

effective sentiment analysis trading requires reliable data sources. the overall daily bias bar pulls from carefully selected inputs:

asset coverage:

- stocks (individual equities)

- futures (market indices)

- or all combined for comprehensive analysis

proven trading strategies: the sentiment analysis aggregates signals from four key approaches:

- opening candle continuation

- initial balance - standard

- initial balance - by rejection

- previous day's range

major market coverage: sentiment analysis trading monitors these critical assets:

MAG 7 stocks:

- AAPL, MSFT, GOOGL, AMZN, NVDA, TSLA, META

major indices:

- SPY, QQQ, ES, NQ, YM, RTY

all data updates throughout the session, ensuring your sentiment analysis trading decisions are based on current market conditions.

the sentiment analysis incorporates data from proven patterns like engulfing bars and other high-probability setups that have demonstrated consistent edge over time.

how to use sentiment analysis in your daily trading routine

here's exactly how to implement sentiment analysis trading in your morning routine:

- step 1: access your sentiment analysis trading dashboard

- step 2: check the overall daily bias bar first

- step 3: if it's 65%+ bullish → look for long setups on individual tickers

- step 4: if it's 65%+ bearish → focus on short opportunities

- step 5: if it's mixed → reduce size or stay out

let data fuel your decisions, not the other way around.

one look at your sentiment analysis tells you if you're trading with the trend or against it.

new to day trading? check out our top 3 day trading strategies for beginners to understand how sentiment analysis fits into broader trading approaches.

why sentiment analysis trading matters for day traders

sentiment analysis trading keeps you out of three major traps:

- fighting trending days no more shorting when sentiment analysis shows everything is bullish. when the data clearly indicates upward momentum across major assets, you align with that bias instead of fighting it.

- getting chopped up early warning when sentiment analysis indicates mixed conditions. choppy days become predictable when you can see divergent signals across your monitored assets.

- emotional trading removes guesswork from bias determination. sentiment analysis trading replaces gut feelings and emotional reactions with objective data from proven trading strategies.

I've been using sentiment analysis trading for the past few weeks, and it's changed how I approach each session.

instead of hoping I'm reading the market correctly, I know what the sentiment analysis data says before I open any position.

for traders looking to completely remove emotions from their trading, our automated trading strategies guide shows how to systematically execute sentiment-based trades.

getting started with sentiment analysis trading

the overall daily bias bar:

- aggregates bias across your selected tickers and proven trading strategies

- lives at the top of your screener dashboard

- gives you three clear signals: bullish, bearish, or choppy

- uses live data from validated trading approaches

this sentiment analysis trading tool is part of our recent platform updates for 2025, designed to give traders instant market bias analysis.

frequently asked questions about sentiment analysis trading

what is sentiment analysis trading?

sentiment analysis trading is a systematic approach that uses data from multiple assets and proven trading strategies to determine market bias. instead of relying on emotions or single indicators, it aggregates bullish and bearish signals to give you objective directional guidance.

how accurate is sentiment analysis trading?

sentiment analysis trading doesn't predict the future, but it gives you the current market bias based on real data from major assets like the MAG 7 stocks and key indices. the accuracy comes from following what the majority of major market movers are actually doing, not trying to guess what they might do.

can beginners use sentiment analysis trading?

absolutely. sentiment analysis trading is actually perfect for beginners because it removes guesswork and emotional decision-making. you get clear signals: bullish (go long), bearish (go short), or mixed (reduce size or stay out). it's one of the most straightforward ways to determine market bias.

what's the difference between sentiment analysis trading and technical analysis?

technical analysis looks at price patterns and indicators on individual charts. sentiment analysis trading aggregates data from multiple proven strategies across many assets simultaneously. instead of analyzing one chart, you get the overall market sentiment in one glance.

how often should i check my sentiment analysis trading signals?

check your sentiment analysis trading dashboard every morning before the market opens. the overall daily bias bar gives you the directional bias for the entire session. you don't need to constantly monitor it throughout the day - the morning read sets your directional framework.

what happens when sentiment analysis trading shows mixed signals?

mixed signals in sentiment analysis trading indicate choppy market conditions. this is actually valuable information - it tells you to reduce position sizes, take profits faster, or stay out completely. knowing when not to trade is just as important as knowing when to trade.

does sentiment analysis trading work for all market conditions?

sentiment analysis trading works in trending markets (bullish or bearish) and helps you identify choppy conditions to avoid. it's designed to keep you on the right side of major moves and out of low-probability, mixed-signal environments.

can i use sentiment analysis trading with other strategies?

yes, sentiment analysis trading complements other approaches perfectly. use it to determine your directional bias first, then apply your specific entry and exit strategies within that framework. it helps ensure you're not fighting the overall market direction.

quick recap

sentiment analysis trading transforms how you approach daily market bias by:

- providing objective data instead of emotional guesswork

- aggregating signals from proven trading strategies

- monitoring major market movers in real-time

- giving clear directional guidance for each trading session

the key to successful sentiment analysis trading is consistency. check your bias bar every morning, let the data guide your directional bias, and avoid fighting clear trending conditions.

whether you're dealing with strong bullish sentiment, clear bearish bias, or mixed choppy conditions, sentiment analysis trading gives you the information you need to make better trading decisions.