what's new in 2026, plus your feedback

we’ve pushed a ton of new features, indicators, and product updates out over the past couple of months — so I wanted this weekend’s stay sharp to cover them from a high level in case you’ve missed any.

and I also want your feedback — which I cover at the end of this email. so please give me 5 minutes of your time so I can make sure whatever we build next meets your needs/solves the issues you’re facing right now.

let's get into it:

what's new on edgeful

1. the new what's in play dashboard

this might be the biggest upgrade we've ever put out.

the old what's in play was useful, but it only showed stats. you still had to flip between reports and tickers to figure out what was actually setting up.

the new version is completely different:

the new what’s in play has three sections:

- in play — setups that have triggered and are tradable right now

- forming — reports still developing (like the ORB or IB before they finish)

- completed — setups that already played out so you know to move on

the left sidebar also has:

data filter — set a minimum probability threshold (65%+, 70%+, whatever you want) from the reports and that’s what you’ll see. no need to waste any time looking through reports on tickers that only have 40% probability of working.

bias filter — with one click of a button, you can filter the reports to a long or short only bias. so if the opening candle report says 76% of the time when the first hour is green the day closes green — you should be bullish. you’ll see that report if you select “long bias” on the sidebar.

view details — if you want to see the exact stat breakdowns or any further price data within the what’s in play, all you have to do is click “view details” and you can see live + historical data without leaving the page.

customizable reports — adjust settings (timeframe, fill percentage) directly from the dashboard.

no more memorizing stats on your favorite tickers. and definitely no more jumping between 10 different reports. you now have one page that shows you exactly what to focus on throughout the session.

if you want to read more about how you can use the what’s in play dashboard in your trading, click here.

2. edgeful AI

we also launched edgeful AI.

it's trained on every report, every stay sharp, every piece of documentation, and all of our methodology. so instead of searching through help docs or watching tutorial videos, you can just ask it.

here are a couple of questions you can ask it right now:

- "how does the ORB report work?"

- "what's the Ultimate Reversal Setup?"

- "how do I set up automation?"

- "what reports should I use for a morning scalp routine?"

this is V0. what's coming next is more exciting — running analysis with live data, combining reports… and eventually helping you create custom TradingView indicators.

watch more on edgeful AI here:

3. the risk calculator

this one's free — no signup required.

plug in your account size and risk per trade, and it shows you:

- how much you're risking per trade (in dollars and percentage)

- how many consecutive losses until you blow your account

- a probability matrix showing how likely it is you'll hit that losing streak based on your win rate

try out the risk calculator here:

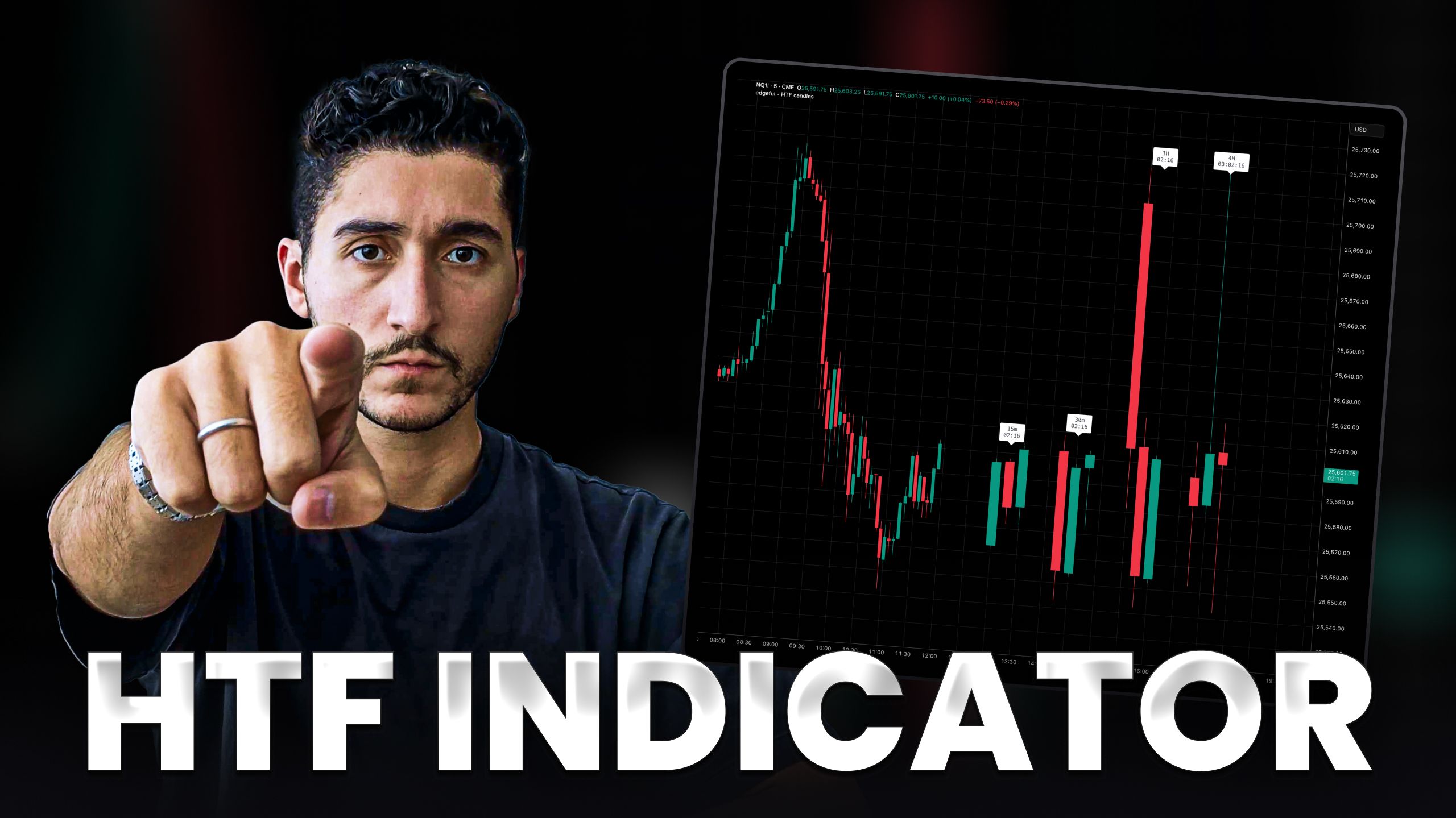

4. HTF candles indicator

this is an indicator I have on my charts every single day now.

and here’s the problem it’s going to solve for you:

you're trading on a 5-minute chart but you need to see where 4-hour resistance is. so you flip to the 4-hour chart, find the level, flip back... and by the time you're done, you've missed the entry.

the HTF candles indicator lets you see higher timeframe candles directly on your execution chart. pick how many candles from each timeframe to display. up to 4 timeframes visible at once.

here’s what it looks like:

and if you want to learn more about the HTF candles indicator, click here.

5. new algos

ORB algo with 2 take profit targets — you can now customize your ORB algo to take profits in two separate orders — which is huge if you have a strategy that looks to capture both runners and quicker scalps.

we’re also coming out with a breakeven stop for the IB algo, which I’ll cover more in depth next weekend.

and if you’re interested in getting access to our entire library of algos (we now have 6), click here.

6. 45+ custom indicators

every edgeful member has access to 45+ private TradingView indicators.

most popular:

- market sessions — auto-plots London, NY, and Asia sessions

- ORB / IB — auto-plots opening range and initial balance levels

- engulfing candles — auto-identifies engulfing patterns on your chart

if you’re interested in learning more about our indicators, click here.

now I have a question for you

we've been working hard over the last couple of months — and we do still have a roadmap for what’s coming next (more indicators, more algos, and a more capable edgeful AI).

but I want to hear from you.

what's on your wishlist?

- what problems are you still facing in your trading?

- what would your perfect tool look like? - what is edgeful missing right now that you need?

- what do you wish edgeful did that it doesn't do yet?

just send me an email — education@edgeful.com and let me know. the team and I will read every single one.

FAQs