master the ORB by performance subreport: setting profit targets based on real market data

this week, I'm going to show you how to trade the ORB — using data — and show you where you can set your profit targets with our ORB by performance subreport.

here's exactly what we're going to cover:

- what the ORB by performance subreport is & how it can help you set data-backed profit targets

- how to use the "by wick" vs. "by close" customizations to set these profit targets based on your style

- why you need to care about the first break of the ORB (not the second or third)

- a step-by-step walkthrough using real examples from March 2025

- how to add the ORB TradingView indicator to your charts — so you don't have to plot the levels yourself every single session

by the end of today's stay sharp, you'll know exactly how to set realistic ORB profit targets based on actual data — not your emotions or random price levels.

and if you'd rather watch a video breakdown of everything you'll master in today's stay sharp, you can do so here: [video link]

understanding the opening range breakout (ORB)

before we look into the by performance subreport, let's quickly cover what the ORB actually is.

the opening range breakout (ORB) is the high and low of the first 15 minutes of trading in any session. for the NY session that's 9:30AM-9:45AM ET. you can customize the opening range to be any length you want on our ORB report, but for today let's focus on the 15min ORB.

4 things can happen on any ORB setup:

1. a breakout — when price moves above the ORB high and doesn't touch the ORB low

2. a breakdown — when price moves below the ORB low and doesn't touch the ORB high

3. a double break — when price touches both the ORB high and the ORB low in the same session

4. a no break — when price stays completely within the ORB high & low for the entire session

the traditional ORB strategy is simple: you can trade the breakouts or you can trade the double break and take the reversal – there's no single way to trade the ORB, but today we're going to cover the breakout strategy using the "by performance" subreport.

let's look at the stats on YM over the last 6 months:

- breakouts: 23.81% of the time

- breakdowns: 28.57% of the time

- double breaks: 47.62% of the time

- no breaks: 0% of the time

the most important takeaway?

even if there isn't a clear edge in the above stats — meaning not one of those 4 scenarios has more than a 60% probability of happening — there is ALWAYS a first break of the ORB range (since no breaks happen 0% of the time).

this is why the by performance subreport is so powerful — it measures what happens after that first break, regardless of what happens later in the session.

what the ORB by performance subreport actually measures

the by performance subreport measures exactly how far price extends after breaking out of the ORB — before breaking back into the ORB range.

important note: it only measures the first break of the ORB, so this will only work on the first break.

if we refer back to our example image from above — we're taking the average move up on a breakout (from the ORB high to the highest wick on the first breakout attempt) or taking the average move down on a breakdown (from the ORB low to the lowest wick on the first breakdown attempt).

this is crucial because it tells you the average move up and down — based on data — of the first breakout move which is key for setting proper targets.

by wick vs. by close — you choose which customization fits your strategy best

one of the most important customizations in this report is the "by wick" vs. "by close" setting. here's what each one means:

- by wick: calculates the move from when a candle's wick breaks the ORB until a candle's wick breaks back into the ORB

the by wick customization is very sensitive. if price wicks out and back into the ORB, that's it, that's the performance – from the ORB high to the top of that wick.

- by close: calculates the move from when a candle closes outside the ORB until a candle closes back inside the ORB

the by close customization needs more confirmation. it requires a candle close outside the ORB to start to check the performance. so if price wicks out but doesn't close out of the ORB, that breakout is ignored.

I'll cover some examples of this in a second, but let's quickly check the data because this small customization has a huge impact on the results:

by wick stats on YM over the last 6 months:

- breakout average: 0.30% move upwards from the ORB high before reversing

- breakdown average: -0.29% move downwards from the ORB low before reversing

important note: by wick customization doesn't consider candle timeframe — it's simply looking at the first wick out and move back in to the ORB range. this can happen on 1min, 5min, 15min, or any other timeframe.

by close stats on YM over the last 6 months:

- breakout average: 0.62% move upwards from the ORB high before reversing

- breakdown average: -0.45% move downwards from the ORB low before reversing

you can see the difference is substantial — the 15 minute "by close" calculation shows nearly double the extension for breakouts and over 50% more for breakdowns.

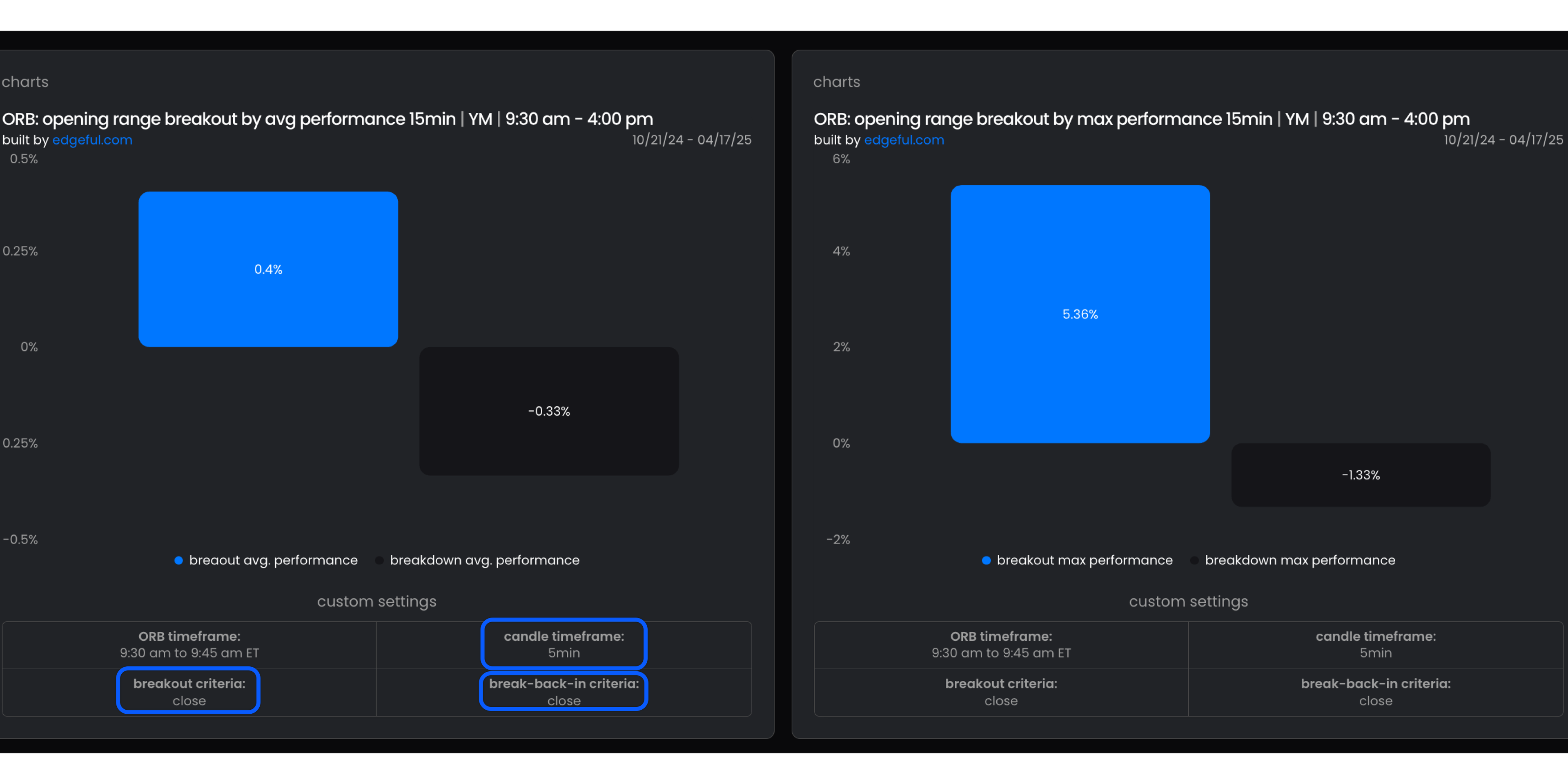

important note: by close customization considers the candle timeframe! a 5min candle may close outside the ORB but a 15min may not close outside the ORB, so if you have 15m selected, you'll have to wait for the 15min candle to close outside the ORB. I'll show you an example in a second, but here are the stats for a 5min candle timeframe for the by close customization:

- breakout average: 0.4% move upwards from the ORB high before reversing

- breakdown average: -0.33% move downwards from the ORB low before reversing

as you can see, the data changes when you customize 'candle timeframe' within the 'by close' variation of the ORB by performance subreport.

the main takeaway here is you can use our reports and subreports to build a strategy that fits your system and personality as a trader — you just have to know what you're looking for.

real-world examples

let's look at three real-world examples to see how everything we've covered above plays out:

Wednesday, March 19th, 2025 - using "by close" and 5min 'candle timeframe' customization

this is a perfect example of the "by close" method in action. YM breaks out of the ORB range and closes above the high on a 5-minute timeframe. the next candle "wicks" below the ORB high but doesn't close below it.

using the "by close" method, the calculation continues until a candle actually closes back within the ORB range. in this case, price extended 201 points (0.48%) before the calculation ended. this move is slightly above the average — which is 0.4% based on what we've covered above — and offers a great area to take profits.

this example also shows clearly how the "by close" method allows trades to continue through normal price volatility compared to the "by wick" customization.

Friday, February 21st, 2025 - using "by wick" or "by close" customization

on February 21st, YM broke below the ORB low with no wicks back into the range - meaning both the "by wick" and "by close" calculations had the same results.

the move touched our average downside move (using the 5min stats above) at -146 points (0.33%), and very close to our 0.29% average for the "by wick" method.

not every trade will result in this big of a home run — but it goes to show how locking in profits at a data-based level allows you to sit for larger moves if they happen.

Thursday, February 27th, 2025 - using "by close" customization

another great example of the by wick vs. the by close customization playing out — you can see that on a 5min timeframe, the wick out moved back below the ORB high in the same candle. this would end the calculation and the trade.

the by close approach would have kept you out of the initial breakout — because it never closed above the ORB high, until about 25 minutes later when the move stuck and moved directly towards our 0.4% average move.

how to implement the ORB by performance subreport in your trading

here's how to actually use this data in your trading:

- identify the ORB (9:30-9:45 AM ET)

- wait for the first break (either above the high or below the low)

- decide which measurement style you prefer (by wick or by close)

- make sure you've chosen the right candle timeframe — 5min or 15min as the data changes (as we've shown you above)

- set your profit target based on the average move from the data:

- for "by wick" on YM: ~0.30% on breakouts, ~0.29% on breakdowns

- for "by close" on YM (15min): ~0.62% on breakouts, ~0.45% on breakdowns

- for "by close" on YM (5min): ~0.4% on breakouts, ~0.33% on breakdowns

6. add the edgeful ORB indicator to your charts to see these levels visually:

- access through the edgeful dashboard by inputting your TradingView username

- look for the "edgeful - ORB - opening range breakout" indicator

the beauty of this approach is that you're now setting profit targets based on what the market actually does — not what you hope it will do or what some guru told you.

wrapping up

let's do a quick recap of what we covered today:

- the ORB by performance report measures exactly how far price extends after the first break of the ORB

- there's a significant difference between "by wick" (smaller moves) and "by close" (larger moves)

- you can add the edgeful TradingView ORB indicator to your charts to visualize these levels automatically, just use the edgeful dashboard!

by using this data to set realistic profit targets, you're no longer guessing where to take profits or leaving money on the table. you're trading with the stats — something most traders don't do.

and remember — there's no "right" way to use this report. you can customize it to fit your trading style. just make sure you're consistent with your approach.