4 reasons why traders lose money: these emotions are killing your account

the real reason why traders lose money isn't what you think

what's the biggest difference between consistently profitable traders and those who keep blowing up their accounts?

contrary to popular belief, it's not the specific setups they trade or their technical analysis skills. understanding why traders lose money comes down to a simple truth: most trading failures stem from emotional decision-making rather than following data-driven approaches.

in this post, we'll explore the four emotions that consistently explain why traders lose money, how using data completely transforms your decision-making process, and provide a practical morning routine to ensure you're trading with probabilities, not feelings.

the 4 emotions explaining why traders lose money

throughout my 7+ years of trading, and after speaking to thousands of traders, I've identified four core emotions that answer the question of why traders lose money consistently:

1. hope — "this trade just needs more time"

hope is what keeps you in losing positions far too long. it's when you're watching a trade go against you, but instead of cutting your loss at your predetermined stop level, you think "it'll come back" or "just let me get back to breakeven."

hope is arguably the most dangerous emotion because it almost always leads to bigger losses. many traders lose money because one or two massive losers wipe out a week or month of gains in a single session.

2. fear — "I need to take profit while I can"

fear is what makes you exit winners too early. you're up 10 points and immediately want to lock in the small profit you've accumulated because you're afraid it might disappear.

usually this fear stems from being burned badly in the past — watching a winning trade turn into a losing one, so now you take gains quickly to avoid the pain of watching open profits evaporate.

this is why traders lose money despite having winning trades — their average win size is smaller than their average loss size. they rely on "hope" when they're in a loser, and then get consumed by "fear" when they're in a winner.

3. greed — "I need to size up to make back my losses"

greed can consume anyone — it doesn't matter how much experience you have.

the main way I've seen greed cause traders to lose money is when they try to recover losses by taking huge, often 2-3x normal risk.

you've had a rough morning, lost a couple hundred dollars, and now you want to make it all back with one big trade. so you double or triple your normal position size, effectively gambling rather than trading.

all it takes is one oversized trade to go against you and you've completely blown your risk limit on a funded challenge — or worse, you've blown your entire account. this explains why many traders lose money rapidly after a series of small losses.

4. lack of confidence/trust in your system — "I'm not sure if I should be taking this trade"

second-guessing yourself keeps you on the sidelines, watching a tradeable setup move without you. or worse, it causes you to enter a trade and then immediately second-guess your decision. so you take a small loss, only to watch the market reverse exactly as you originally anticipated.

this hesitation is another key reason why traders lose money. it typically stems from a lack of confidence in your strategy, which ultimately comes from not having enough concrete data to support your decision-making.

how data-driven trading prevents why traders lose money

now that we've identified the emotional traps that explain why traders lose money, let's look at how using data changes the equation:

hope → objective exits

instead of hoping a losing trade turns around, you have to rely on data to tell you exactly when to get out. this takes all of the decision-making out of it, leaving no space for emotions to creep in and make you hold longer than you should.

a concrete example is using the by spike subreport for gap fills to set logical stop losses. this subreport measures the average upside or downside continuation off the open — essentially measuring the drawdown you need to expect if you entered right at the open before the gap fills.

you can use this data to:

- wait to enter until the by spike value plays out (objective)

- set your stop below the by spike value low (objective)

when you get stopped out, you can actually build confidence in your decision-making and discipline because you followed rules and data unemotionally. many traders lose money because they fail to implement these objective exits.

fear → data-backed targets

rather than taking profits a couple of points after the trade goes your way, you have to rely on data to tell you the most logical areas to take profits — based on the probabilities each setup gives you.

relying on gut feel is a common reason why traders lose money over a large number of trades.

for example, when trading the ultimate bullish setup (which combines multiple reports), you can use the inside bars report to confidently target yesterday's high or low. the data shows that when price opens within yesterday's range, there's a high probability of it tagging either of these levels.

you can see how when you actually put in the time to get comfortable with these numbers, you're able to rely on them and make decisions quickly when the setup plays out.

no second guessing, no fear, just simple levels to execute at — and fewer traders lose money when following this approach.

greed → trusting the stats

using the right data to support your trading can eliminate the temptation to size up randomly by showing that edge comes from consistency, not from gambling.

even if you take 3 or 4 losses in a row, you have to know that you're that much closer to a winning trade. if you've studied the setup enough to know the stats, you'll find peace in the fact that you will be a winner over a large set of trades.

there's no room for greed — just execution based on the data in front of you. when traders lose money through oversizing, it's almost always because they abandoned this principle.

indecision → clear triggers

you'll never have to second guess an entry or exit again when you realize how powerful relying on data to build concrete entry and exit rules is.

no more hesitation because your decisions are based on data-backed setups — something 95% of traders don't have. this is why many traders lose money: they lack clear, objective triggers for their trades.

your practical morning routine to avoid why traders lose money

the biggest barrier between emotional trading and data-driven trading is simply having a process before you ever place a trade. here's a practical morning routine to make sure you're using data, not emotions, to make decisions:

7:30am: first look at the session ahead

check three key things before the market even opens:

- what happened overnight in other sessions?

- are there any gaps forming?

- is there any major news that might impact volatility?

notice there's no forming of biases yet — just getting warmed up with what's happened while away from the market. many traders lose money because they come into the session with preconceived notions rather than observing what's actually happening.

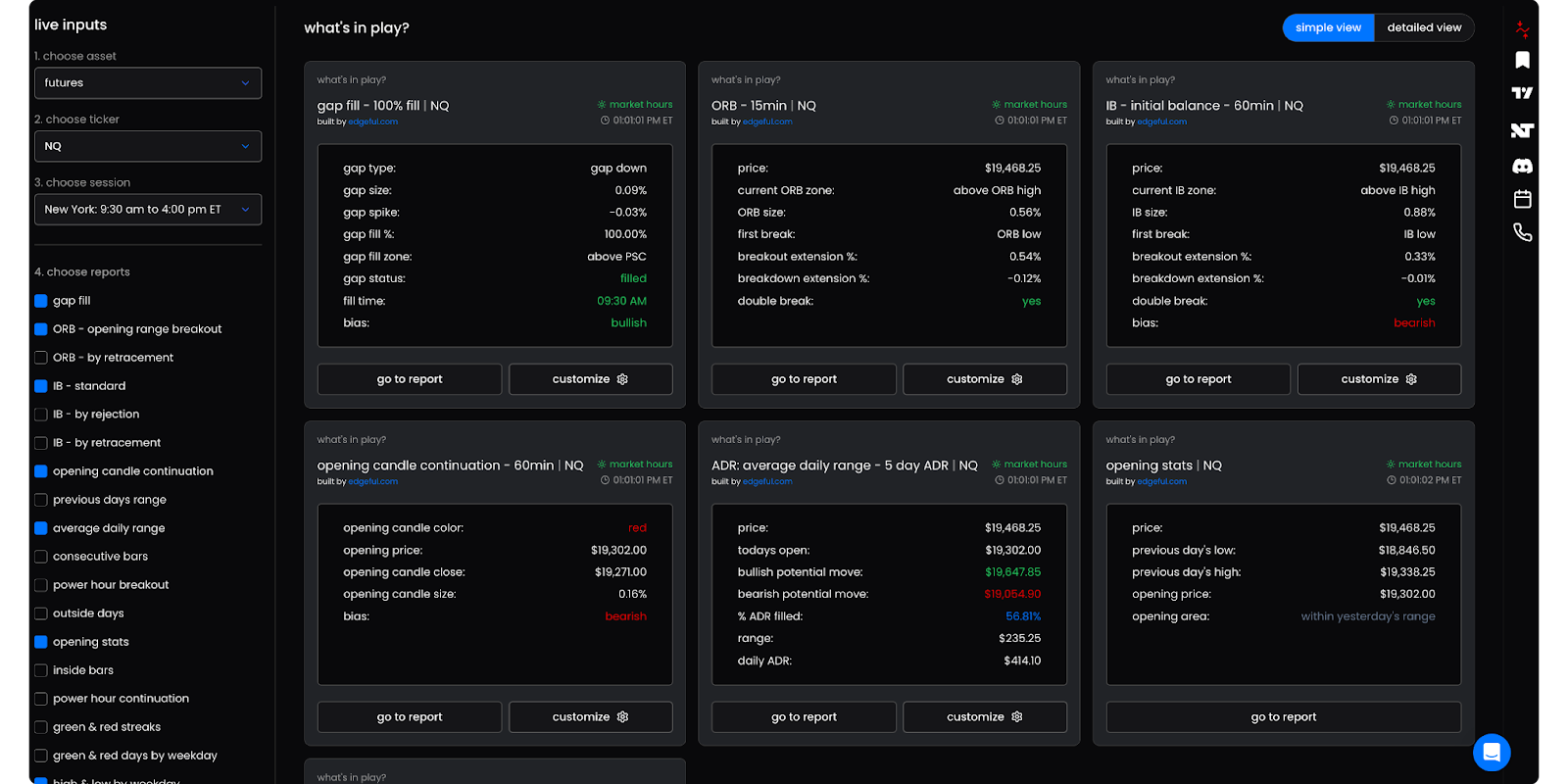

8:45am: prepare your data dashboard

this is where the data preparation begins. pull up your key reports:

- gap fill — to see if any gaps are likely to fill

- opening range breakout — gauge the key levels for the first 15min of trading

- outside days — to see if you're opening outside yesterday's range

- initial balance — to prepare for potential breakouts after the first hour

- opening candle continuation — checking the bias of the first hour

for each report, look at the 6-month probabilities to ensure you're using recent, relevant data — not outdated stats from 1-2 years ago. traders lose money when trading based on patterns that may no longer be relevant.

9:30-9:45am: observe the opening range

during the first 15 minutes, don't place any trades. instead, let the opening range set itself and then let the key levels for your strategies play out.

no emotion — just letting the action tell you where your bias/focus should be. impatience is another reason why traders lose money in the first minutes of trading.

9:45-10:30am: get a wide view across markets

now look for alignment across multiple tickers on the same report. For example, if there isn't a clear direction one way or another — meaning some setups are bullish and some are bearish — reduce your level of aggressiveness.

use data — not what you feel should be happening — to adapt to what the market's giving you on the session. traders lose money when they fight the market instead of adapting to it.

throughout the session: data-based entries & exits

now that you have your bias and reports in place, let your entries and exits be determined by the data:

- entries come at key levels identified by the reports

- stops are placed at levels where the data says your trade idea is invalidated

- targets are set at statistical points, not arbitrary price levels

the difference between this process and emotional trading? every decision has a stat behind it — you're not guessing or hoping. this is how you avoid the common reasons why traders lose money.

5 steps to stop being one of the traders who lose money

here's your action plan to start trading with data instead of emotions:

- identify high-probability setups - find 3 reports with 65%+ probabilities on your preferred ticker

- create a comprehensive plan - combine these reports to create specific entry triggers, stop levels, and profit targets

- commit to consistency - trade only setups that align with your plan for at least one month

- review objectively - analyze each trade afterward to make sure you followed the data, not your emotions

- scale gradually - slowly increase position size as your confidence in the data grows

the real power comes from sticking to this process even when it feels uncomfortable. most traders lose money because they abandon their plan at the first sign of trouble.

the most successful traders use data not as a collection of cool indicators, but as an emotionless trading system that gives them the confidence to execute consistently day after day.

the long-term impact of shifting from why traders lose money to why they win

traders who successfully make the transition from emotional to data-driven decisions often report these changes:

- reduced stress - knowing your decisions are backed by statistics rather than hunches

- improved consistency - less variance in daily P&L

- better risk management - position sizing based on probability rather than emotion

- increased confidence - each trade executed according to plan reinforces trust in your system

- sustainable growth - compound returns through steady wins rather than rollercoaster results

when you understand why traders lose money and actively work to avoid those pitfalls, your trading transforms from a stressful gamble to a calculated business.

wrapping up: the truth about why traders lose money

i always try to be as transparent as possible, and here's the truth: i still battle these emotions every single day. the difference is that i've built a system of reports and data that help me overcome them.

remember — understanding why traders lose money is the first step to avoiding the same fate. the most successful traders aren't the ones with some secret indicator or magical pattern. they're the ones who've learned to trade based on probabilities instead of emotions.

the market doesn't care about your feelings. it doesn't care if you need to make money today or if you're trying to recover yesterday's losses. it simply presents opportunities based on supply and demand dynamics.

by focusing on the data and removing emotions from your trading decisions, you align yourself with these market realities rather than fighting against them. this is the ultimate solution to the question of why traders lose money.

want to stop being one of the traders who lose money consistently? explore our data-driven platform to transform your approach to the markets.