futures trading taxes: complete guide for beginners (2025)

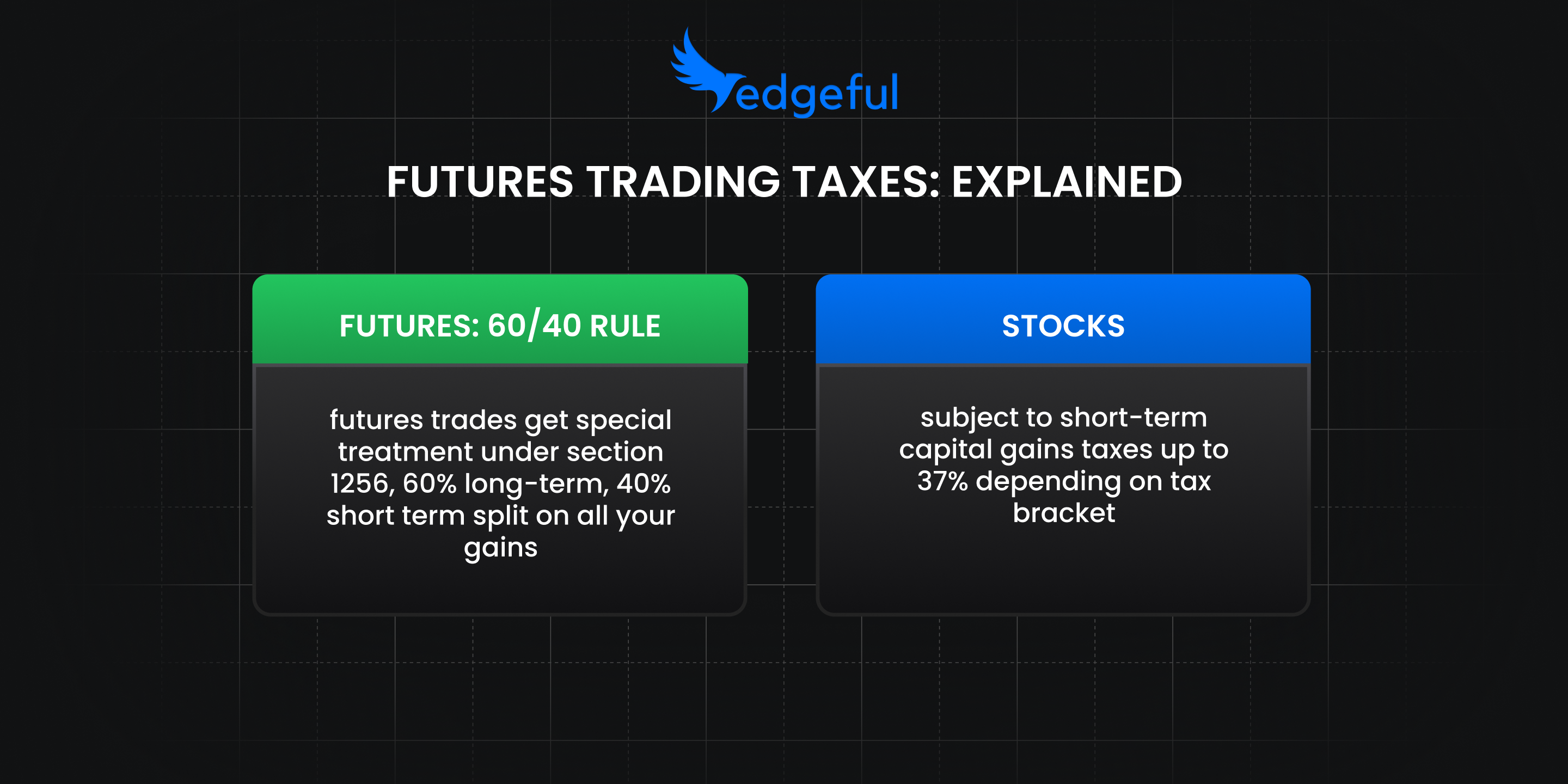

here's the thing about futures trading taxes that most traders don't understand... they're actually way better than stock taxes.

I've worked with thousands of traders over the years, and the same question comes up every tax season: "how do I report my ES and NQ profits?" the good news? futures trading taxes are simpler and often cheaper than what you'd pay on stocks.

unlike stocks where you're stuck with short-term capital gains rates (up to 37%), futures get special treatment under section 1256. this means a 60% long-term, 40% short-term split on all your gains... regardless of how long you held the position.

let's break down everything you need to know about futures trading taxes so you're not scrambling come april.

table of contents

- what makes futures taxes different from stocks

- the 60/40 rule explained (with real examples)

- which forms you'll actually need to file

- section 1256 contracts: what qualifies

- step-by-step tax calculation examples

- wash sale rules for futures (spoiler: they're different)

- frequently asked questions

- key takeaways for your tax season

what makes futures taxes different from stocks

the biggest difference? futures are marked-to-market at year-end, whether you close your positions or not.

this means if you're holding 10 ES contracts on December 31st, the IRS treats them as if you sold them at fair market value. then on january 1st, they're treated as if you bought them back at that same price.

sounds complicated, but it's actually simpler than stock taxes in practice. here's why:

- no tracking individual lot dates and holding periods

- no wash sale rule complications (more on this later)

- automatic 60/40 tax treatment on all gains and losses

- loss carryback options that don't exist with stocks

your broker handles most of the heavy lifting with form 1099-B reporting, but you still need to understand the basics to file correctly.

before we dive into taxes, make sure you understand margin requirements for futures trading.

the 60/40 rule explained (with real examples)

that's the best part about futures trading taxes... the 60/40 split gives you a lower effective tax rate than pure short-term trading.

here's how it works: every dollar of futures gains gets split into 60% long-term capital gains and 40% short-term capital gains. this applies whether you held the position for 5 minutes or 5 months.

real dollar examples with ES and NQ

scenario 1: $15,000 profit from day trading ES

- 60% treated as long-term gains: $9,000 × 20% = $1,800

- 40% treated as short-term gains: $6,000 × 37% = $2,220

- total tax: $4,020

- effective rate: 26.8%

compare this to stocks where the full $15,000 would be taxed at 37% = $5,550 in taxes.

scenario 2: $8,000 loss on NQ trades

- 60% long-term loss: $4,800

- 40% short-term loss: $3,200

- both can offset other capital gains at full value

the math gets even better in lower tax brackets. if you're in the 22% bracket, your effective futures tax rate drops to around 18.4%.

why this matters for active traders

most day traders and scalpers would face 37% tax rates on stocks (plus state taxes). the 60/40 rule can save serious money... we're talking thousands of dollars on a decent trading year.

which forms you'll actually need to file

let's get into the paperwork. most futures traders only need two main forms:

form 6781: your main futures tax form

this is where all your section 1256 gains and losses get reported. it has two parts:

- part i: gains and losses from section 1256 contracts

- part ii: straddles (most traders can ignore this section)

your broker's 1099-B will show your net gain or loss for the year. you'll enter this number on line 1 of form 6781.

schedule D: where it all flows together

the totals from form 6781 transfer to schedule D, then to your main 1040. the form automatically applies the 60/40 split for you.

when you might need form 8949

here's what most traders mess up... form 8949 is only needed if:

- you have adjustments to your broker's 1099-B reporting

- you're making mark-to-market elections under section 475

- you have wash sales between futures and stocks

for standard futures trading, form 6781 and schedule D handle everything.

broker 1099-B reconciliation tips

always double-check your broker's numbers against your own records. some brokers aggregate differently, and you might need to make adjustments for:

- open positions marked-to-market on December 31st

- different contract months treated separately

- fees and commissions (usually included in gain/loss calculations)

section 1256 contracts: what qualifies

not all futures contracts get the special 60/40 treatment. here's what qualifies:

regulated futures contracts

- ES (E-mini S&P 500): ✓ qualifies

- NQ (E-mini NASDAQ): ✓ qualifies

- MES (Micro E-mini S&P): ✓ qualifies

- MNQ (Micro E-mini NASDAQ): ✓ qualifies

- commodities like crude oil, gold, wheat: ✓ qualifies

- currency futures: ✓ qualifies

broad-based stock index options

- SPX options: ✓ qualifies

- NDX options: ✓ qualifies

- RUT options: ✓ qualifies

what doesn't qualify

- individual stock options (AAPL, TSLA, etc.)

- narrow-based index options

- forex spot trading (different from currency futures)

- cryptocurrency futures (still evolving, check current rules)

as you can see, most futures traders are dealing with section 1256 contracts. if you're trading ES, NQ, and their micro equivalents, you're getting the 60/40 treatment.

step-by-step tax calculation examples

let's get into the actual numbers with real trading scenarios...

example 1: profitable year with multiple contracts

trader profile: day trader focusing on ES and NQ annual results:

- ES trades: +$22,000 profit

- NQ trades: +$8,000 profit

- total: +$30,000 profit

tax calculation (assuming 37% ordinary rate):

- 60% long-term portion: $18,000 × 20% = $3,600

- 40% short-term portion: $12,000 × 37% = $4,440

- total federal tax: $8,040

- effective rate: 26.8%

vs. stock day trading:

- $30,000 × 37% = $11,100 federal tax

- savings with futures: $3,060

example 2: net loss with carryback opportunity

trader profile: experienced trader with losing year annual results:

- total section 1256 loss: -$15,000

options available:

- carry forward: offset future gains (standard approach)

- carry back: amend previous 3 years' returns to get refunds

if you had $10,000 in section 1256 gains two years ago, you can carry back $10,000 of current losses and get an immediate refund.

example 3: mixed year with strategic considerations

December 31st positions:

- holding 5 ES contracts with $3,000 unrealized profit

- holding 3 NQ contracts with $1,500 unrealized loss

- net unrealized: +$1,500 (this gets marked-to-market)

realized trades during year:

- closed positions: +$12,000 profit

total reportable:

- realized gains: $12,000

- mark-to-market gains: $1,500

- total: $13,500 subject to 60/40 treatment

wash sale rules for futures (spoiler: they're different)

here's where futures trading gets really interesting... section 1256 contracts aren't subject to wash sale rules.

that means you can:

- sell your ES position for a loss on Friday

- buy it back on Monday

- still claim the full loss for tax purposes

this is huge for active traders who might need to manage risk or take profits/losses around year-end.

but there's a catch with mixed portfolios

if you're trading both futures and stocks, wash sales can still apply between related positions:

- selling SPDR S&P 500 ETF (SPY) at a loss

- buying ES futures within 30 days

- this could trigger wash sale treatment on the SPY loss

record-keeping best practices

even though wash sales don't apply to futures-to-futures trades, keep detailed records:

- trade confirmations for every position

- daily statements showing mark-to-market values

- separate tracking for futures vs other investments

- documentation of any section 475 elections

the IRS recommends keeping these records for at least 3 years, but i'd suggest 7 years to be safe.

frequently asked questions

do you pay tax on futures if you don't close positions?

yes, because of mark-to-market accounting. if you're holding ES contracts on December 31st, they're treated as sold at fair market value for tax purposes. you'll owe taxes on any unrealized gains (or can deduct unrealized losses).

what is the futures tax rate compared to stocks?

futures get the 60/40 split treatment, creating an effective rate of about 26.8% at the highest brackets. stocks held less than a year face the full short-term rate of up to 37%. that's a potential 10+ point difference in tax rates.

can you carry back section 1256 losses?

yes, this is one of the best features. you can carry back net section 1256 losses up to 3 years to offset previous section 1256 gains. this can generate immediate refunds, unlike stock losses which only carry forward.

how do state taxes treat futures gains?

most states follow federal treatment, but some have different rules. california, for example, doesn't recognize the 60/40 split and taxes futures gains as ordinary income. check your state's specific regulations.

does the wash sale rule apply to futures trading?

no, section 1256 contracts are exempt from wash sale rules when trading futures-to-futures. however, wash sales can still apply between futures and related stocks/ETFs.

key takeaways for your tax season

- futures trading taxes are usually better than stocks - the 60/40 split saves money for most active traders

- mark-to-market happens whether you want it or not - December 31st positions get taxed on unrealized gains/losses

- form 6781 is your main tax form - most traders won't need form 8949 for standard futures trading

- ES, NQ, MES, and MNQ all qualify - these popular contracts get full section 1256 treatment

- no wash sale headaches between futures - you can trade in and out of positions without timing restrictions

- keep detailed records - even though brokers provide 1099-B forms, maintain your own trading logs

- consider loss carrybacks - if you have a losing year, you might be able to amend previous returns for immediate refunds

- year-end planning matters - those December 31st positions will affect your current year taxes

once you understand the tax benefits, here are some top TradingView indicators you can apply to maximize your futures trading.

the bottom line? futures trading taxes are designed to be simpler and often cheaper than stock taxes. but you still need to understand the rules and file the right forms.

if you're dealing with complex situations like trader tax status elections or multi-asset portfolios, definitely consult a tax professional who understands section 1256 rules.